a year. Numerous studies show that 10 percent of propertyand casualty claims and 36 percent of bodily injury claims involvefraud or inflation of otherwise legitimate claims. Workers'compensation fraud has been a particularly troublesome area for theindustry, costing insurers and employers about $6 billion a year,according to the Coalition Against Insurance Fraud (CAIF).

a year. Numerous studies show that 10 percent of propertyand casualty claims and 36 percent of bodily injury claims involvefraud or inflation of otherwise legitimate claims. Workers'compensation fraud has been a particularly troublesome area for theindustry, costing insurers and employers about $6 billion a year,according to the Coalition Against Insurance Fraud (CAIF).What Fraud Looks Like

Claimant fraud trends have been on the rise in recent years,reflecting current economic conditions. Claimant fraud occurs whenfalse or exaggerated injury claims, such as those not received onthe job, are filed. The National Insurance Crime Bureau (NICB)reports that as the economy has deteriorated over the last severalyears, the number of suspicious or questionable claims hasincreased. For instance, the NICB states that the number ofquestionable claims related to workers' compensation increased 71percent between the first quarter of 2008 and the first quarter of2009 alone.

Equally troublesome is the impact increased medical costs havehad on workers' compensation. Traditionally, 60 percent of injuryclaim amounts covered the indemnity payment while the remaining 40percent covered medical costs. Today, the relationship hasreversed, illustrating how dramatically medical costs have risen,while frequency and indemnity payments have decreased.

|Such a significant increase in medical costs can be partiallyattributed to a rise in provider fraud, when medical or treatmentproviders exaggerate treatments for minor injuries or bill fortreatments not actually provided. The increased involvement oforganized crime can drive up medical costs as well. Such crime caninclude storefront clinics where no treatment is rendered ordurable medical equipment providers that do not supply equipment topatients.

|Employer premium fraud is another aspect ofworkers' compensation fraud facing the property and casualtyinsurance industry. Employer fraud occurs when an employerunderreports payroll, misrepresents job classifications or businesstype, or misclassifies employees as independent contractors in aneffort to reduce workers' compensation insurance premiums.

|Fighting Fraud on Two Fronts

The industry is currently fighting back hard against the problem offraud, focusing on two major antifraud efforts: fraud awareness andinvestigation/enforcement. In regard to fraud awareness, insurersare placing greater emphasis on fraud training for claims adjustersand underwriters to help them identify signs of suspect behavior orclaim patterns. Furthermore, support for public fraud awareness andeducation has been broad, involving not only insurers but the CAIF,consumer interest groups, and the NICB as well.

Industry efforts to fight against fraud have also beenencouraged by regulators and legislators across the United States.In fact, 38 states have established insurance fraud bureaus, andseveral others have pending legislation designed to support theantifraud effort.

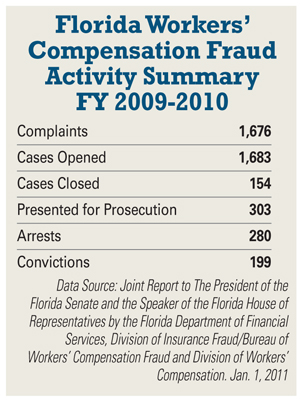

|On the fraud investigations and enforcement front, the insuranceindustry, lawmakers, and law enforcement have invested significantresources in investigations and subsequent arrests and prosecutionsfor fraudulent activities. For example, in the 2008–2009 fiscalyear, the California district attorney's workers' compensationfraud program prosecuted 1,090 cases involving 1,221 suspects—resulting in 555 convictions and orders for restitution totaling$23,767,448. In Florida, the Department ofFinancial Services Division of Insurance Fraud reported that infiscal year 2009-2010 it received and reviewed 12,820 insurancefraud referrals that resulted in 1,234 cases presented forprosecution and 1,042 arrests. The 706 convictions resulted incourt-ordered restitution totaling $63,061,289.

|Of the total number of fraud referrals, 13 percent—or 1,676referrals—were for suspect workers' compensation cases.

|According to a 2007-2008 report from the CAIF, Florida'sDivision of Insurance Fraud leads the nation in the recovery ofinsurance fraud-related losses through court-ordered restitution.In fiscal year 2008-2009, cases presented for prosecution by theDivision of Insurance Fraud resulted in more than $34 million incourt-ordered restitution. According to the Coalition's 2007-2008statistics, Florida ranks in the top four among all states' frauddivisions and bureaus in key measurements of success,including:

- Second in the number of arrests

- Third in the number of cases presented for prosecution

- Fourth in the number of referrals

During 2009 and 2010, the Florida Bureau ofWorkers' Compensation Fraud was restructured and now is acompletely independent unit within the Division of Insurance Fraud.According to the division, the restructuring will enable a morefocused approach to combating various types of workers'compensation insurance fraud. It will also make the bureau moreresponsive to changing trends, since all fraud referrals arechanneled through one contact point within the division.

|Technology as an Antifraud Weapon Regardless of the type of fraud occurring in the workers'compensation sector, insurers, law enforcement, and employers,among others, have faced challenges in investigating andidentifying fraudsters. However, effective technologies andanalytic capabilities are rapidly changing the antifraudlandscape.

Regardless of the type of fraud occurring in the workers'compensation sector, insurers, law enforcement, and employers,among others, have faced challenges in investigating andidentifying fraudsters. However, effective technologies andanalytic capabilities are rapidly changing the antifraudlandscape.

Industrywide claims databases have been an invaluable tool inthe fight against fraud for many years. Insurers and investigatorscan use claims histories to analyze activity and uncover suspiciouspatterns or pre-existing injuries. Additionally, claims handlerscan use the database to more easily identify potential fraudindicators or red flags within a suspicious claim. For example, thedatabase can help a claims handler identify multiple bodily injuryclaims filed under the same Social Security number that havesuspiciously similar circumstances. Databases can also provideinsight into medical provider billing activity or medical sanctionsand may uncover questionable patterns.

|Data analysis and visualization software can also graphicallyshow relationships between data elements in claims, helping toreveal suspicious behavior. These tools can connect data elements,such as all claims associated with a particular medical provider orlinks between individuals that appear in several claims. Thesoftware can easily sift through millions of pieces of data andconnect each element to every other data component with which ithas a relationship. Advanced predictive analyticshas also proven to be extremely helpful in flagging suspiciousclaims. Regression analysis, social network analysis, and textmining can examine vast numbers of claims and their attributes.Claims systems can then use the outcomes to score claimcharacteristics and identify red flags and patterns of claims.

|Premium audit models are another effective tool insurers can useto combat the problem of employer fraud. When insurers routinelyaudit commercial accounts, the audits should include frauddetection to ensure the accuracy of the premium collected forworkers' compensation. Insurers use predictive models to optimizeaudit resources and effectiveness in three key areas: decidingwhich accounts to audit; determining the most efficient allocationof mail, telephone, and physical audits; and optimizing the orderof audits so any additional premium due the company can beidentified early.

|Conclusion

Fraud is an ongoing problem in the workers' compensation sector andit costs insurers and self-insureds millions of dollars each year.However, as advanced analytic technology evolves, the insuranceindustry will be well equipped with a full arsenal of tools todetect fraudulent activity.

Though the challenges from fraud rings and fraudulent activitywill continue to be formidable, the leaders of the 21st centuryinsurance industry will be those that use technology and analyticseffectively to succeed and thrive.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.