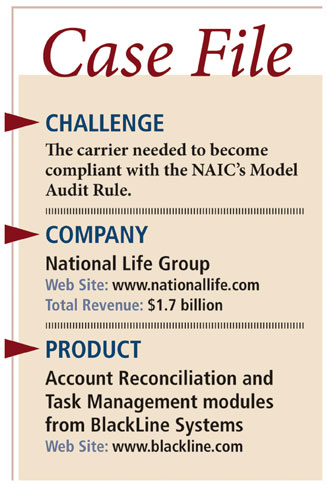

When the National Association of Insurance Commissionersapproved the Model Audit Rule in 2006—the industry's version of theSarbanes-Oxley Act for non-public companies—it mandated internalcontrol reviews. For the National Life Group, that meantimprovement was needed in its manual processes for accountingreview, according to Paul Brissette, director of corporateaccounting for National Life.

|“Prior to 2007, all of our account reconciliations weredon e on paper with approvalsignatures required on the paper copies,” says Brissette.

e on paper with approvalsignatures required on the paper copies,” says Brissette.

Handling all that paper was a fulltime job for a member of theaccounting team, gathering hundreds of accounts, tracking down therequired signatures, making copies, and organizing everything intothree-ring binders.

|“Manual reconciliations were creating logistical problems,causing errors, and costing us valuable staff time,” saysBrissette. “We needed a solution to automate our accountreconciliation process.”

|One solution that National Life considered was available only asan enterprise solution, which would have created another layer ofresources from the IT department.

|After viewing a demo, the National Life team, which included thesenior vice president of finance and the corporate controller, wassold on BlackLine Systems.

|“The BlackLine consultant was extremely knowledgeable about theproduct and had a solid understanding of the importance of accurateand timely reconciliations,” says Brissette.

|A point that influenced National Life's decision was BlackLine'stask management module, according to Brissette. Up to then, thecarrier kept track of quarterly financial statement tasks in Excelfiles.

|“Putting this list of tasks in BlackLineenabled us to make the list accessible to all users, whilemaintaining a central location from which to monitor deadlines,status, etc.,” he says.

|Within a month of going online with the BlackLine system,Brissette reports 81 percent of National Life's accounts werereconciled. By June 2007, just three months after implementation,96 percent of accounts were reconciled. By the end of 2007, thecarrier had reached its goal of 100 percent reconciled items.

|Four years later, National Life looks at the accountreconciliation process as being both painless and reliable.

|“After the first year, most users were viewing BlackLine astheir normal tool for monthly tasks, as well,” says Brissette.“Internal and external auditors are pleasantly satisfied with thistool, as it gives them access to accounts with supporting documentsat their fingertips, without having to wait for someone tophysically deliver the reconciliation to them in paper form.”

|BlackLine is a Web-based solution, so technology demands werenot an issue, according to Brissette. National Life is using theSaaS/OnDemand version, so Internet access is the only thingbusiness users need.

|“Currently we upload our account balances daily,” saysBrissette. “We set up a process that creates a separate upload fileeach time we are posting GL transactions. Twice a day, the file isimported automatically into BlackLine.”

|What made the implementation special for the insurer wasBlackLine's ability to respond to any deficiency in thereconciliation process.

|“We've completely automated previously manual,processes,” says Brissette. “BlackLine has virtually eliminatederror-prone, spreadsheet-driven accounting processes.”

|Workflow and email reminders through the task management moduleand the ability to view documents attached by the preparer havestreamlined the carrier's accounts review process.

|Previously, a staff member was in charge of manually keepingbinders current. Today, that employee spends time helping reviewdocumentation supporting the account reconciliations.

|“We have essentially saved at least the cost of one full-timeaccounting-team employee, by being able to assign that person toother more strategic roles,” says Brissette. “Not to mention thesavings we've seen from eliminating costs associated with the heapsof paper and binders. Now, all reconciliations and supportingdocuments are stored in a single online repository.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.