Over the next five years, we should expect dramatic changes inclaims handling and fraud detection—mirroring emerging trendsalready evident in society today. What will this brave new worldlook like? What are the key trends, and what will be their impacton the claims-handling and fraud-fighting workflow between now and2016?

| Here are some predictions:

Here are some predictions:

• The Explosion Of SocialNetworking

|Whether communicating via Facebook, Twitter, Tumblr, YouTube orother social networking sites, consumers are opening up theirlives—and possibly revealing details that could be helpful toclaims adjusters and fraud investigators. The trend has alreadybegun, for example, with workers'-compensation fraudsters postingpictures and messages online, revealing that their health is muchbetter than they had led claims administrators to believe.

|• The Rise Of InformationEverywhere

|Where is news, entertainment and e-mail accessed? Today, theanswer includes TVs, desktop computers, laptops, iPads, smartphones and even gaming systems. While many of today's informationtechnologies are entertainment-oriented, in the not-too-distantfuture the entire claims process could well be carried out on thesedevices. The old model of sitting at a desk to do work is changing,as work moves with people to their cars and even to theirpockets.

|The impact for claims adjusters is significant. The currentclaims-analysis systems tied into desktop and mainframe systemswill be available as mobile applications that will allow on-siteclaims information gathering as well as instantaneous claims-dataanalysis. We already see evidence of such trends in mobile accessto estimating data for auto and property.

|• Telematics

|Today it's possible to locate people by triangulating theirposition via their cellphone GPS. That technology is a useful toolin crime investigations. The next-wave technology in a similar veinis telematics. When telematics devices are installed in vehiclesand transmit data, insurers know not just where but how drivers areoperating their vehicles. The data provided by telematics devicescan inform underwriting decisions and reduce misrepresentation offact in auto accidents.

|• New Uses For SatellitePhotography

|Today, satellite photography is used primarily for assessment ofweather conditions and to assist scientists in measuring globalchange. Image resolution is getting sharper, however, and the rangeof available images is getting larger all the time. The impact forproperty-claims evaluation will be significant. In the future,checking the validity of property claims may be as easy asaccessing high-resolution photographs of the property before andafter a loss event, all done virtually—from anywhere in theworld.

|• Expanded Uses For Weather Data

|Weather data has greatly improved meteorologists' ability topredict storm systems. And the accuracy with which weather eventscan be measured has also significantly increased. Today, technologyallows the detection of lightning strikes within a two-mile radius.In the future, data will be even more precise, affecting propertyclaims in which unscrupulous property owners try to fake structuraldamages to receive payments. Weather forensics—such as detecting ifor when there were lightning strikes or wind damage in thevicinity—will become easier in the future, helping investigatorscatch property owners and unscrupulous contractors who wish to takeadvantage of local weather events.

|• Data-Driven Investigations

|In today's claims investigation world, claimsadjusters collect information, and if something seems irregular,they alert the SIU staff. The investigator then makes phone calls,hits the street and knocks on doors to discover the facts of thecase: a time-consuming and laborious process.

|In five years, this model will be turned on its head. As soon asclaims data is input, the system will begin searching throughmultiple channels of information to seek out suspicious data andbehaviors. The explosion of information currently beinggenerated—through social networking, news outlets, weather data,telematics devices, satellite photography and other data-gatheringsystems—will be accessed instantly, with each aspect of the claimbeing checked for possible fraud.

|

Predictive and network modeling will look at data to identifywhich claims require special handling or investigation. The datawill tell investigators whom to pursue: the clinic that alwaysbills just up to the threshold that won't trigger an investigation;the claimant who uses four Social Security numbers; or theauto-repair shop that bills the insurance company for new parts butinstalls used ones.

|In 2016, the speed of investigations will seem lightning fast incomparison with current methods. Once a suspicious individual orbusiness is discovered, the investigator will be able to drill downwith just a few clicks to put the case together. The old days ofhitting the streets will be replaced with hitting the device. Andin 2016, investigations will be as mobile as the personalcommunications routines of today.

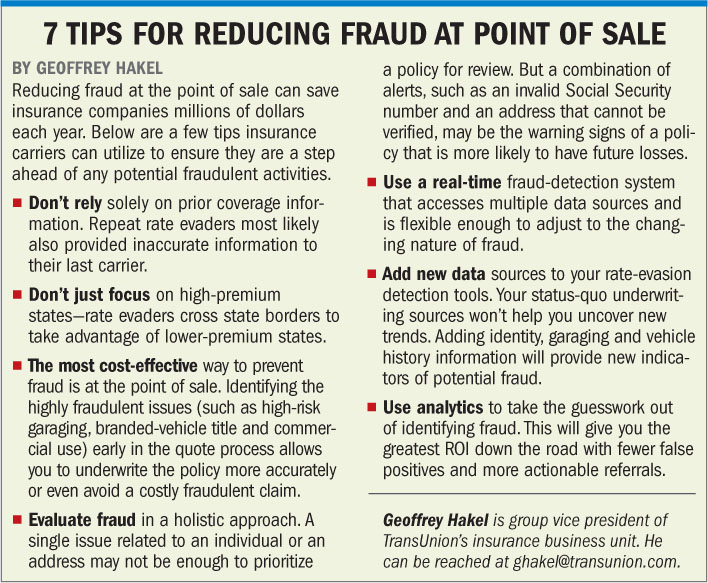

|• Point-Of-Sale Perimeter Defense

|A decade ago, insurance applicants came into the office to applyfor a policy, and the agent could actually get to know theapplicant. Today, the personal interaction is being replaced by anonline application—and what's frequently lost is the ability toevaluate the applicant in a personal way. In five years, applicantswill still be applying online, but the decisions of agents andunderwriters will be supported by rigorous prescreeningtechnology.

|From the moment applicants begin to research an insuranceproduct online, the screening system will begin to analyze theiridentities and their insurance and loss histories. The system willalso look at other available records, such as whether there is acriminal or insurance-related fraud background. By the time theapplication is submitted, the system will already have gathered andscored information to know much about individual applicants and therisk of fraud. Insurers will be able to stop would-be fraudsterswell before they become actual policyholders.

|• Implications

|In the next five years, developments in communications,information acquisition and analytic techniques will allowunderwriting and claims staffs to collect better data, performbetter analytics and make better business decisions. Theimplications for insurance-claims handling and fraud fighting willbe both exciting and challenging. Companies that move forward withtechnology but still maintain a collaborative relationship amongthe underwriting, claims and investigations staffs will have a legup on the competition.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.