Q. What about outside the wide-scope disasters? Is there adiscussion for other less catastrophic type claims?

Q. What about outside the wide-scope disasters? Is there adiscussion for other less catastrophic type claims?

A. Yes, we have also added two other chapters.One goes beyond first-party property coverage (Chapter 11) anddiscusses BI issues as they relate to product liability, builders'risks, and other types of insurance. In Chapter 12, we elaborate ontechniques for handling claims in today's modern corporation, suchas the use of technology, the paperless claim, and dealing with internationallosses. Finally, we have sought the guidance ofseveral well-known and respected professionals in the field, suchas David Goodwin of Covington & Burling LLP, David Barrett andPeter Rosen of Latham & Watkins LLP, and Peter Khan and BradRidden of the forensic accounting firm Matson Driscoll &Damico. They provided us with different perspectives on the BIclaims process. Their contributions as additional writers certainlyenhance the book.

|Q. How has technology changed the claim process? Howcould it be misused in a claim?

|A. Technology is a double-edged sword. We discuss in thebook not only ideal use but also the misuse of technology. Oneexample of misuse is when a policyholder is simply trying to checka box of supplier documents for an adjuster and does so byforwarding large quantities of data to the insurer in a vacuum,with little or no explanation of its relevance. This can bedetrimental to the claims process. Insurer representatives who arealone in their office without direction, guidance, and meaningfulcontext can develop presuppositions and misinformed opinions thatcan create unnecessary obstacles that policyholder must thenovercome.

|Q. What about the best use of technology in a businessinterruption claim?

|A. The book provides policyholders withguidance to enable them to use technology to present data in amanner that tells a holistic story of loss from summary to detail.Custom accounting reports and their corresponding supporting datafor review by the insurers are typically ineffective without asummary of the entire claim that tells the story of the loss to theorganization. The organization should use spreadsheet tools toassimilate the large quantity of supporting data into a set ofclaim schedules that build up, almost pyramid-like, into summaryschedules by primary claim categories that insurers and theirrepresentatives can review easily. These spreadsheets can beprepared by the policyholder or by a qualified claims accountingprofessional, but they should provide a step-by-step explanation ofthe claim being made, from the executive summary to the lowestlevel of detail. Effective use of technology and claim schedulescan expedite review of the claim by insurer and help to keep theclaims process for the modern corporation on track.

||Q. Tell us more about the “paperlessclaim.”

|A. We now have the use of Web-based tools tostore documents “in the cloud” or by some other electronicmeans. For example, invoices and substantive reports canbe converted to either a DVD format or a Web-based site that can besecurely accessed by both the client and the adjuster. Also,advanced data analytics tools can combine large sources of datainto one database or identify anomalies and patterns using advancedalgorithms. In simple terms, technology offers many ways to sortthrough and analyze data to identify more meaningful relationshipsand trends. This is especially important in the area ofunderstanding sales trends and relationships between variable costand production data. Finally, maintaining all relevant files on alaptop increases efficiency.

|Despite these potential problems, technology and data in themodern corporation can have significant advantages in the claims process. Datamanagement—the manner in which information is gathered, analyzed,and shared—is one of the first protocol steps in the insuranceclaims process. Gone are the days of overwhelming volumes of paperinvoices and hard-copy summaries of financial statements.Electronic data allows information to be shared easily withinsurers for their review, expediting the adjustment of the loss.Claims adjusters and their experts no longer need to manageindividual cases by traveling to companies, gathering information,interviewing personnel, and remaining on-site to ask questions asthey arise. Instead, today's claims adjuster can work multiple lossfiles in a remote location while accessing vast volumes ofinformation forwarded from claimants to adjusters via email andonline secured working environments such as eRooms. Each of thesetechniques allows the organization to efficiently update insuranceclaim data and share relevant information with insurerrepresentatives.

|However, technology alone is not the answer. To drive the claimsprocess and settle the claim reasonably, those insureds must domore than provide the documents requested by insurers and theiraccountants. They must commit the resources necessary to gather,interpret, and explain the documentation relevant to the claim.Modern accounting and information systems have the ability to storeand produce an avalanche of data, and providing mountains ofinformation without the proper context can lead to a prolongedperiod before settlement can be reached.

|Q. Does the book provide a mechanismto navigate through all of the company's data pertaining to a givenclaim?

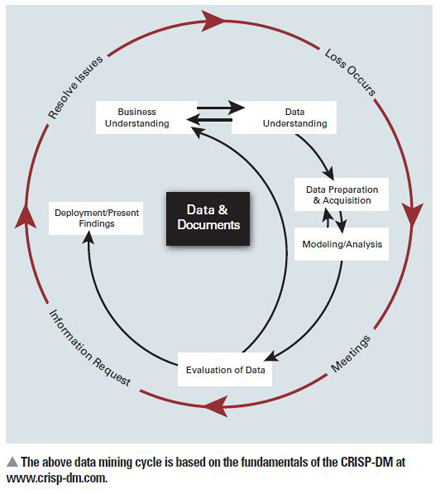

|A. Yes, we have continued discussion about thedata gathering and claim documentation process by aligning theCross Reference Industry Standard Process for Data Mining, alsoknown as “CRISP-DM,” and wrapping these standards around the claimsprocess.

|Each of these processes is described in detail in thebook. Taking the time to fully educate all parties on theinsured's business model can be helpful in determining exactly whatdocuments are truly required to demonstrate the loss. Manycompanies may assume that an adjuster and (his or her) expertsalready know their company's business. This is often far from thetruth and it may be the first time the adjustment team is facedwith the business issues around your loss. If the adjustment teambetter understands how the insured makes money and incurs losses,then they will be more apt to ask the right questions and seek therelevant information to review. This knowledge also will help themaudit the claim and present sufficient evidence to accuratelysupport the loss to the carriers and underwriters. The insuranceclaim CRISP-DM provides that roadmap. For more information aboutthis method, go to www.CRISP-DM.org.

|Q. What are some other big issues withsucceeding with a business interruptionclaim?

|A. The three big issues are: 1) Coverage: howcan the policyholder respond?; 2) How should the BI claim becalculated?; and 3) Timing: how long is the business interruptionperiod? Sometimes all three of these issues overlap. Inmy own experience, I have witnessed people on both sides of theequation agree that disputes over the BI time period are often themost controversial. These disagreements often result in the largestdollar differences between the loss amounts derived by the insurerand insured. Why is this so? One reason may be that this issue ofhow much time should be used to measure the BI loss overlaps somany others. The applicable time period is often, as a matter ofpolicy wording, measured by the time needed to rebuild a damagedfacility.

|Timing is a function of scope of loss. It is affected by theextent of damage, the ability to make repairs, safety concerns,regulatory issues, and loss prevention concerns. It includes theamount of time required to clean up a loss site from a fire orinsured event and rebuild or restore operations to normal, and itcan be subjective, thus engendering disputes between the insuredand its insurers on the critical path toward complete restorationof operations. Such disputes can greatly influence the accountingissues as well. That is, although production may be back, theaccountants may disagree as to whether such production is at thepre-loss level.

|Time-related disputes often fuel (or arefueled by) issues relating to coverage or policy wording andengineering and quantification. The rebuilding of the World TradeCenter complex is a perfect example of the convergence of theseissues. With codes changes, and the build out of the lower Westside of Manhattan since the completion of the Trade Center in 1972,the pure logistics and code requirements to maneuver equipment anddeal with the subterranean subway issues may not have been itemsthat either the policyholder or insurers envisioned when writingthe policy.

|Q. What are some of the challenges andbenefits of working on a book like this?

|A. The biggest challenge is the combination ofdealing with your normal job and then working on thebook. The great part is in working with otherprofessionals both co-authors and contributing authors and seeingtheir innovative ideas about how to address certain topics. Also,other professionals challenge your thinking. I especially like howthe three new chapters turned out that were led by Allen Melton,one of my co-authors and partners in our insurance claimspractice.

|Q. What advice do you have for today's young claimsprofessionals?

|A. Get as much experience as you can about adiverse type of claims and industries. Always read the policy andbackground on the company before you walk into your first meeting.I have always enjoyed the breadth of experiences of learning aboutdifferent industries and working with different people. Every timeyou think you have seen it all, a totally new situation comes intoyour lap. I was involved with the appraisal recently on a $3billion claim, and one of the final open claims from the WorldTrade Center. I was exposed to issues relating to the rebuilding ofa train station, valuing art work, calculating the re-work ofdetailed engineering drawings, and getting into the engineering ofhow the World Trade Center was actually designed and constructed inthe 1960s and completed in the early 1970s.

|

*Disclaimer: The views expressed herein are those of theauthors and do not necessarily reflect the views of Ernst &Young LLP.*

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.