A little more than a century ago,The New York Times ran a brief article detailing the commotion at ahorse auction held at old Madison Square Garden. It was1909, andalongside more than two dozen equines that were put up on the blockwas a lone automobile. As though it was a horse, the car was ledout with a halter attached, and the auctioneer called out its fullpedigree, including dam, sire, age, and mark.

A little more than a century ago,The New York Times ran a brief article detailing the commotion at ahorse auction held at old Madison Square Garden. It was1909, andalongside more than two dozen equines that were put up on the blockwas a lone automobile. As though it was a horse, the car was ledout with a halter attached, and the auctioneer called out its fullpedigree, including dam, sire, age, and mark.

According to the article, it was “the first time that a motorcar intruded in such a manner on the premises where horse is king,and the invasion was hailed with derision,” later described asjeers, laughter, and hoots of a thousand horsemen. But we all knowhow things turned out for the automobile.

|A Virtual Revolution

|Flash forward to the present, and another technological seachange is again revamping the way things are done. This timeinstead of the automobile replacing the horse, it is live virtualauctions replacing physical, in-person auctions. Not only is thischange revolutionizing auto auctions, it is changing how insurancecompanies manage the disposition of salvage vehicles acquired aspart of the claim settlement process.

|Salvage auto auctions were originally formed to save insurancecompanies the costs and hassles involved with dealing withcontracted auto wreckers or salvage yards. Rather than continuewith this inefficient logistical nightmare, cars were pooledtogether and buyers were allowed to bid on them. Salvage autoauctions were born.

|The ensuing years brought various innovations, such as replacingsealed bids with live auctions, and bringing the events indoorsinstead of out in the cold. But nothing quite changed the face ofauto auctions like the Internet. When the Internet gainedwidespread popularity in the mid-1990s, one of the first uses thesalvage industry found for it was as a powerful marketing tool. Itno longer needed to mail or fax lists of cars to potential buyers,a process that was labor-intensive and time consuming.

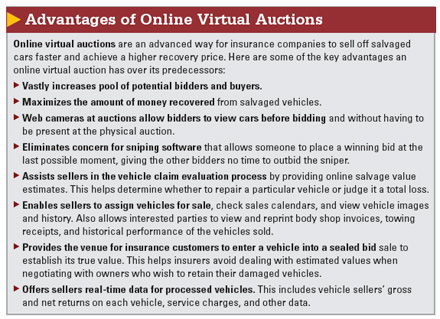

|But this was only the beginning. It was not until the advent ofvirtual online auctions that the salvage auto industry harnessedthe true power of the Internet. In addition to being a greatmarketing tool, virtual online auctions provide claim managers withan outlet to sell off salvaged autos fast and for a high recoveryprice. Insurance companies can utilize this technology to enhanceoperating efficiency through Internet bidding, salvage valuequotes, electronic communication with buyers, vehicle imaging, andonline used vehicle parts locator services.

||Test Driving the Process

|To illustrate, let's look at a virtual online auction technologythat employs a two-step bidding process. The first step is an open“preliminary bidding” feature that allows a buyer to enter bidseither at a bidding station in a vehicle storage facility inadvance of the actual auction date, or over the Internet.

|To improve the effectiveness of bidding, the auction allowsbuyers to see the current high bid on a vehicle they want topurchase. Buyers then enter the maximum price that they are willingto pay for the vehicle, letting the computer incrementally increasethe bid on their behalf during all phases of the auction.

|Preliminary bidding ends one hour prior to the start of thesecond bidding step, an Internet-only, live virtual auction. Thisstep allows bidders the opportunity to bid against each other andthe high preliminary bidder. Buyers enter bids via the Internet inreal-time, while an automated program submits bids for the highpreliminary bidder, up to their maximum bid. When bidding stops, acountdown is initiated. If no bids are received during thecountdown, the vehicle sells to the highest bidder. Because it'sall done online, it's available to buyers anywhere who haveInternet access—including overseas.

|Indeed, unlike the U.S., most countries are not majormanufacturers of automobiles and do not have the ability to meetdomestic demand, so many foreign countries import their vehicles.Online vehicle auctions have enabled foreign buyers to purchasecars online in the U.S. for shipping overseas. Today, some of thelargest export markets for salvage vehicles in the U.S. are inEastern Europe. This trend has provided an opportunity forsellers—the insurance companies—to expand their markets byconnecting with customers globally, move vehicles quickly, andlower claim costs while providing other benefits for theinsured.

||Other Benefits

|These are but a few of the benefits. For instance, a liveauction that might be canceled due to inclement weather would stillbe held in an all-electronic model. Online virtual auctions do nothave to rely on physical attendance. When a hurricane hit Tampa afew years ago, 250 cars were sold in a virtual auction thatotherwise would have not been held.

|Bringing auctions online has also helped eliminate theopportunities for collusion. With the Internet, buyers who want toplace a bid at an auction they can't attend simply enter their bidsinto a computer rather than going through an onsite auction managerwho may handle multiple competing bids. By eliminating the humanelement in the auction process, an even playing field is createdfor all bidders, along with improved transparency.

|Virtual online auctions also allow sellers to contingently sella vehicle through the auction process to establish its true value,allowing the insurance company to avoid dealing with estimatedvalues when negotiating with owners who wish to retain theirdamaged vehicles.

|The next logical step for the auto auction industry is to moveto an entirely electronic title format. This will reduce the cycletime of the whole process when insurers are chasing down a titlebeing held by a bank or title warehousing facility.

|The shift to an entirely electronic format will only continue tohelp in expediting vehicle turnaround time in terms of speed andcycle time in and out of the auction yard. This can translate intolowered claim costs for insurers, allowing them to receive the mostvalue for damaged vehicles in a short amount of time. A fast,efficient turnaround can increase the return on investment for theinsurance company.

|

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.