Premiums for commercial transportation insurance businesscontinued falling for almost all types of accounts in the secondquarter of 2010, but the number of insurers writing transportationbusiness rose, according to a recent survey of marketparticipants.

|The second-quarter survey known as TIPS–an acronym forTransportation Insurance Pricing Survey–from NIP Group, aWoodbridge, N.J.-based wholesale broker and program manager,tallies the responses to questions about market conditions fromleading transportation insurance brokers, wholesalers andunderwriters representing thousands of account placements, NIPsays.

| In the second quarter, over 60percent of respondents reported that more insurers wereunderwriting transportation business, compared to just about 53percent in first-quarter 2010 and 50 percent a year earlier, insecond-quarter 2009.

In the second quarter, over 60percent of respondents reported that more insurers wereunderwriting transportation business, compared to just about 53percent in first-quarter 2010 and 50 percent a year earlier, insecond-quarter 2009.

“Transportation tends to be a place where excess insurancecapacity is allocated. So because it's transitory capacity–it canbe utilized to gain premium–it tends to be a place whereunderwriters will venture when they want to grow their top lines,”Richard Augustyn, chief executive officer of NIP Group, toldNU.

|“When underwriting capacity becomes scarce, they withdraw,”leaving only the dedicated transportation underwriters who are itin for all cycles, he continued.

|Given these dynamics, transportation market conditions “may becorrelated with the direction of the overall [commercial] insurancemarket. It may be a leading indicator,” said Mr. Augustyn, whosefirm has participated in the Northeast regional transportationmarket for more than 20 years through a wholesale division and aretail subsidiary known as Marquis Transportation.

|In that respect, the survey brings bad news from the perspectiveof insurers about the duration of the soft market. Asked to givetheir opinions of the overall direction of the transportationmarket, over three-quarters of the respondents said it was “soft”or “softer” during second-quarter 2010.

|In contrast, during second-quarter 2009, 40 percent ofrespondents reported “flat” market conditions, while 37 percentsaid the market was “soft.”

|Joe Hutelmyer, president of AmWINS Transportation Underwritersin Burlington, N.C., confirmed that this year's market is softer“without a doubt” than last year's, but he did not seeparticipation from a lot of new players.

|“In the past, when we got a soft market, it was strictly tied tosupply and demand,” said the 35-year veteran of the commercial automarket, recalling that more than 100 carriers flooded the truckinsurance marketplace in the late 1990s. When capacity retreatedand prices fell in the middle of the current decade, the number hadfallen to less than 15, he noted.

|Recently, “we've had an influx of a few markets, but not aninordinate amount,” he said, putting the number between six and 10,including standard carriers dabbling in commercial auto business.“It is supply and demand, but it's just a little bit different thanit's always been in the past,” he added, chalking up the differenceto the economy.

|“There's less business for maybe a few more players,” he said,contrasting today's market of roughly 30 participants overall to apeak of 116 in the very soft early-1990s.

|There are six-to-10 carriers that have been around for the longhaul and are specialists, another five-to-10 that are MGA-drivenand also specialist carriers, and then another 10-to-12 dozen that“really don't have any business being in the business,” heobserved.

||Mr. Hutelmyer, who gave an example of historical price changesin an article he authored for NU's Feb. 24, 2003edition–citing an average liability tractor-trailor price of $5,302for $1 million of coverage per power unit in 1985–said the samerisk would be priced at around $4,600 in 2010.

|Even after considering medical and other types of inflation,“the tractor-trailer price is less than it was 20 years ago, whichis scary,” he said.

|He noted, however, that the risk “is a better write” than it wasback then.

|“The federal government has done a good job” with regulationsrelated to drug testing and commercial driver license requirements,he said, adding that the actual equipment has improved as well.

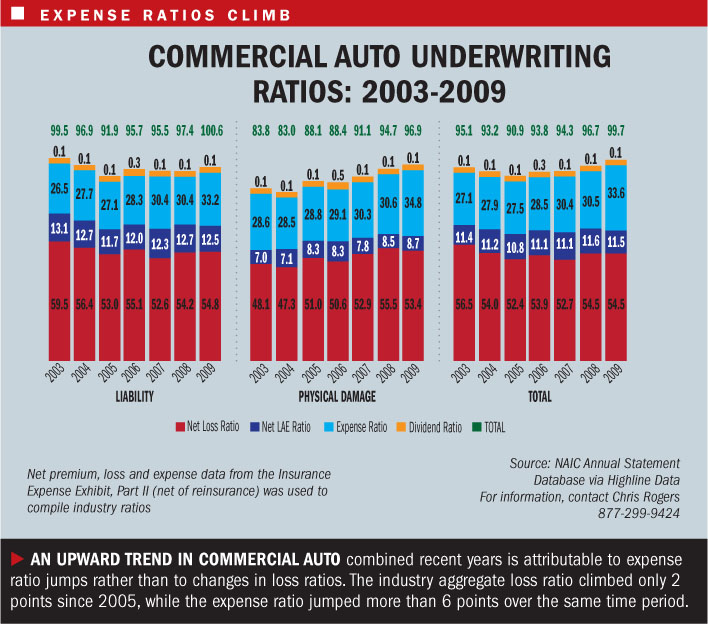

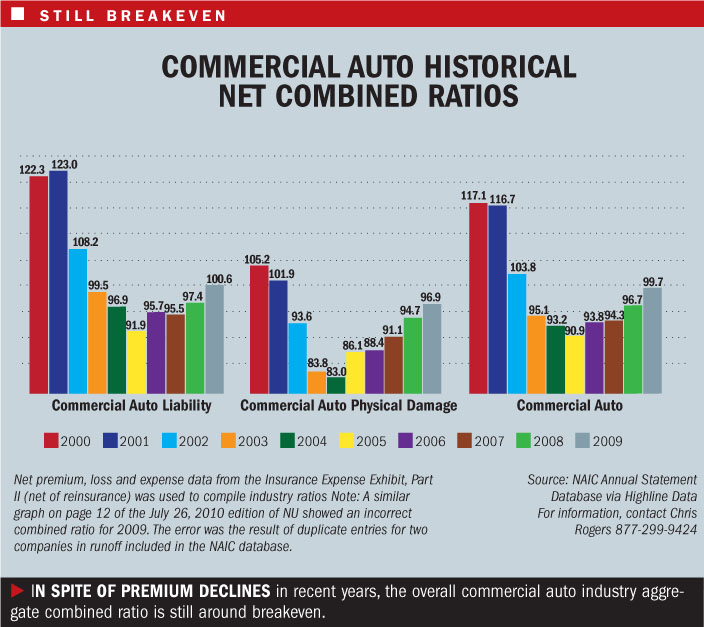

| In fact, insurance industrystatistics reveal that in spite of premium declines in recentyears, the overall commercial auto industry aggregate combinedratio is still around breakeven. An upward trend in recent years isattributable to expense ratio jumps rather than to changes in lossratios, which remained relatively flat.

In fact, insurance industrystatistics reveal that in spite of premium declines in recentyears, the overall commercial auto industry aggregate combinedratio is still around breakeven. An upward trend in recent years isattributable to expense ratio jumps rather than to changes in lossratios, which remained relatively flat.

Deane Sager, a trucking industry specialist for NorthlandInsurance, said the trucking industry over the last three-to-fiveyears has experienced a continuing drop in fatalities “to the pointnow that the current numbers are record-setting,” going back towhen they started keeping records on injury accidents involvinglarge trucks. (See http://bit.ly/aSQcN3 for moreinformation.)

|Pointing to factors such as more safety technology and moreattention to hours-of-service rules, Mr. Sager said that while thedown economy may also be a cause, the drop in fatalities involvinglarge trucks is in fact greater than the drop in milestraveled.

|Mr. Hutelmyer believes the economy did “shake out somenot-so-good operators.” Gone are some “that were operating on ashoestring–that couldn't afford to pay better drivers [or] maintaintheir units,” raising the overall risk quality level of thetrucking industry, he added.

|Focusing on the demand for insurance, Mr. Hutelmyer said thedown economy caused the commercial auto market to shrink 25 percentover the last few years, but demand has leveled off in recentmonths.

|QUARTERLY CHANGES

|Price reductions also leveled off during the year based on asecond- to first-quarter comparison of responses to the TIPSsurvey.

|Compared to last quarter, “it appears that rate reductions arenot intensifying,” Mr. Augustyn said. So there may be “some mixedsignals,” he noted, contrasting the quarter-to-quarter comparisonto indications of year-over-year softening.

|“Rate reductions may have peaked. That is the ray of hope here,”he said.

|In its reports for various quarters dating back to midyear 2008,NIP graphically reveals the extent of premiums changes indicated bysurvey respondents for 10 different segments:

- Trucking Operations

- Intermodal Carriers

- Specialized Carriers & Riggers

- Bulk Transportation

- Messenger/Courier Services

- Charter/Tour Bus Operators

- School Bus Contractors

- Limousine Services

- Ambulance and Medical Transport

- Airport Ground Transportation

The survey summarizes overall premium changes, which includerate and exposure changes together, not just price changes, Mr.Augustyn confirmed.

||NU's comparison of the latest survey with prior reportsreveals that even segments showing the lowest declines insecond-quarter 2010, such as charter buses and airport groundtransportation, show greater premium drops than they did in thesame quarter a year ago.

|For airport ground transportation, for example, one-third ofrespondents reported no change in premiums last year, while theremainder reported increases in second-quarter 2009. Insecond-quarter 2010, in contrast, 68 percent reported declines.

|Similarly, in trucking segments such as specialized riggers orbulk haulers, respondents reported premium changes mainly rangingfrom single-digit drops to increases when they were surveyed insecond-quarter 2009. A year later in second-quarter 2010, nearly 20percent reported double-digit declines in these categories.

|For those looking for harder market tea leaves in the surveyresults, however, a comparison to first-quarter 2010 shows morepromise. Roughly 30 percent of respondents reported double-digitdeclines in these specialized rig and bulk transport categoriesduring the first quarter.

|Other categories showed similar changes from the first quarteras well. For the trucking operations and intermodal categories,roughly 35 percent of respondents reported double-digit declines infirst-quarter 2010, with all responses averaging to declines in the8-to-9 percent range (by NU's calculation). One quarterlater, declines averaged 6-to-7 percent, and only one-quarter ofsurvey participants reporting double-digits drops.

|

SIZE STILL MATTERS

|Looking at the business by account size, the NIP survey reportedbigger price decreases for larger accounts during the secondquarter–a relationship consistent with prior reports.

|In second-quarter 2010, only 28 percent of market participantsreported double-digit premium declines for small commercialtransportation accounts (those with less than $75,000 in premium),while nearly 42 percent reported such declines for medium-sizeaccounts ($75,000-$250,000). For large accounts (more than$250,000), 56 percent of survey respondents reported double-digitdeclines.

|Mr. Hutelmyer told NU that his firm, which focused onfleet accounts historically, moved to non-fleet business in recentyears because fleet pricing just became too competitive. “We lostall our renewals,” he said–reporting, however, that his firmsuccessfully transitioned to smaller accounts pushing policy countsup 500 percent.

|“We're growing,” he said, reporting premium growth of roughly 3percent.

|AmWINS underwriters with 35 years experience writing truckfleets are now underwriting one- and two-unit operations, “but it'spaying their salaries,” he said.

|He also reported that non-fleet business is better business froma loss-ratio standpoint. Revealing results of an internal study offleet and non-fleet results over a 20-year period, he said thatfleet business was priced roughly 15 percent cheaper thannon-fleet, and the non-fleet loss ratio was around 10 pointsbetter.

|“You can get your price” on non-fleet business. In addition,there are more variables involved in underwriting fleet businessthan when writing a single operator with one truck and one driverto check out.

|In spite of risk-engineering efforts on fleet business, a fleetowner can suddenly pick up a new contract and add 10 drivers, orpick up a driver on a trip-lease to a haul a particular load,potentially changing the overall quality of the risk.

||At NIP Group, Mr. Augustyn identified the intermodal segment ofthe transportation market as an area of opportunity for the future.“We're certainly in an import-export economy,” he said, explainingwhy this segment, relating to the movement of freight vehicles orcontainers on trucks between other modes of transportation (ship,railroad), should grow over time.

|CARRIER PERSPECTIVE

|Asked to identify areas of opportunity in the transportationmarket at Chicago-based CNA, John Baskam, vice president and leaderof the carrier's specialty transportation unit in Atlanta, said hebelieves the best opportunities come from quality specialists ordistribution partners.

|“It's all about your distribution, and from there, it's amazingwhat kind of opportunity flows,” said Mr. Baskam, who spoke toNU with John Angerami, senior vice president of CNA SelectRisk (the excess-and-surplus lines operation of CNA).

|

Together they described the carrier's continuing commitment andsignificant investment in transportation business and its effortsto identify quality wholesale broker partners and adequately pricedbusiness.

|Earlier this year, CNA Select Risk completed the construction ofa “center of excellence,” Mr. Angerami reported–referring to acentralized facility, led by Mr. Baskam and staffed byunderwriting, risk control and claim services professionals whospecialize in transportation industry risks.

|“Even though we have that 'center of excellence,' we choose tobe less than aggressive when it comes to writing new business andcompeting on price,” Mr. Angerami said. Instead, “we sit [and] lookfor the rare opportunity where we can write a risk on our terms,”he added, vowing to keep the facility in good condition until themarket cooperates and prices rise.

|“We'll be around when others aren't,” Mr. Angerami said,repeating a message he said he delivers to producers.

|Likewise, Mr. Baskam emphasized the firm's longevity, financialstrength and specialized services as central to the insurer'smessage. “We have that value, so we want to flaunt it,” hesaid.

|While the two men reported that CNA's nine-year uninterruptedcommitment to the transportation area has included recentexpansions into new market segments, such as charter buses andlimousines, Mr. Baskam said more than half the prior distributionforce has been eliminated.

|“One of the commitments of Select Risk Transportation is to dealwith the specialist that understands value and quality business,”Mr. Baskam said, noting that the carrier, working with a limiteddistribution model, has culled distributors who were not on boardwith the value-over-price proposition.

|The intent of reviewing the distribution partnerships was not toget rid of distribution, even though that was the outcome. Instead,it was to focus on those that made sense, he said, describingquality producers as specialists motivated to do business on CNA'sterms.

|“If someone comes and says I've got 30 markets, we'd love to addyou, then that's probably not someone who is going to fit in. Theymay control some good business, but they but don't care about thevalue of your operation,” he said.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.