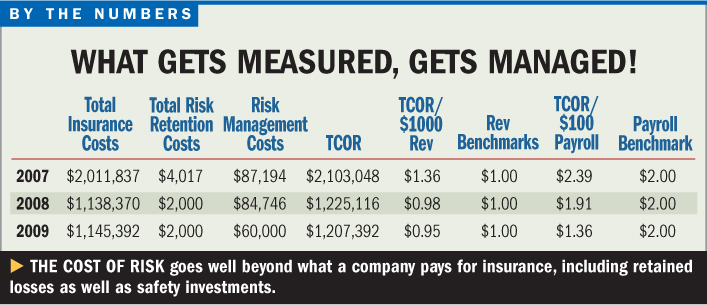

“What gets measured, gets managed!” This statement is thefundamental principle behind the concept of “Total Cost of Risk.”But what exactly is TCoR, and why should you as a risk manager careabout it?

|There is risk associated with everything we do in life. But intoday's world, business risk must be quantified, including theexpense of preventing events from happening in the first place.

|The purpose of any risk management program is to controlenterprise-wide risks, which will ultimately lead to a reduction ofthe total costs associated with these exposures.

|Businesses assume costs of risk to operate. The question is,what is the dollar value of managing these risks, and how can youreduce it?

|You can define “cost of risk” as a quantifiable, controllablenumber that can be identified and reduced. Simply put, itrepresents:

|o The total cost of your insurance premiums, plus

|o Retained losses (deductibles/uninsured losses), in additionto

|o Internal/external risk control costs

|By recognizing these costs, we can plan and implement managementstrategies to reduce them.

|Most people assume TCoR is their insurance premiums alone. Theyare only partially correct, as premiums are just a piece of thepuzzle. While insurance premiums are the most visible costassociated with risk, they are hardly the only expense.

|There are many other costs associated with risk that are eithernot tracked or are viewed as fixed costs. That is the paradigm.

|What most business owners don't realize is that these additionalcosts are controllable.

|

All of the costs related to risk can be tracked and monitored.In addition, there are operational strategies that can beimplemented that will manage and ultimately reduce these costs.

|In breaking down the components of TCoR, the first and mosteasily tracked is insurance premiums. This includes the amount anorganization spends on insurance coverage and brokers'commissions.

|The next element–retained losses–is the amount of money that afirm spends out of pocket for losses incurred. These are costs thatfall within a company's deductible. (An example is a small mishapsuch as drycleaning a client's suit due to spillage from anemployee.)

|The next applicable costs may not be as easy to track but arestill important components captured in the TCoR calculation. Theseare the costs needed to protect your employees or customers frominjuries. (Examples are safety equipment, mats, warning signs,training, etc.) These costs should be tracked as part of the TCoRfor your business internally.

|The next component is money spent with professional firms tohelp you handle insurance or other risk-associated issues. Thesewould include costs for an attorney to respond to a complaint or toreview a contract's indemnification agreement. These are also partof the TCoR calculation and are considered as external risk controlcosts.

|Other relevant costs are productivity declines due to injuriesor losses. Having your employees spend their time either drivingfellow workers to the doctor, investigating incidents, cleaning upspills, etc., are also costs that are risk-related and are takingaway from your bottom line.

|So, why do I care about TCoR? The answer is, “how can I notcare?” All of the costs that I have discussed above impact thebottom line. By tracking TCoR and designing a customized strategyto control these costs, savings can be realized on the bottomline.

|That means every dollar saved is a dollar of improvement inprofit.

|What can I do with this information? Once you have tracked allthese costs for at least the last two years, what's next?

|As a risk manager, I would go through each of the strategiesthat the business has in place to address each component. We woulddiscuss how effective they have been and what we should do toimprove them.

|For example, if you are having slips and falls, spending more onsafety may reduce your overall costs. My point is a dollar saved iseasier than a dollar earned. These dollars are found money!

|I cannot stress enough that any risk management program thatdoes not look at the Total Cost of Risk is missing criticalopportunities.

|Richard W. Sarnie, CSP, P.E., is senior vicepresident and chief operating officer at The ALS Group in UpperSaddle River, N.J. He may be reached at [email protected].

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.