For some it's a battle, for others it's a complement. Thedirection of personal lines insurance is a source of continuingdebate as insurers define and hone their channel strategies betweenagent-based sales and direct to the consumer.

|As usual, technology is the key to defining the direction aninsurer wants to travel and the success carriers can anticipate.Having the right systems in place often means getting beyond legacysystems, which inhibit both customer-facing and agent technology,points out Chad Mitchell, senior analyst, e-business and channelstrategy, for Forrester.

|“Companies that have done the heavy lifting over the last threeyears in updating the mainframes and bringing on agile technologiesin the back office are going to enable channel integration,” hesays. “They ultimately will be able to take advantage of theemerging technologies for the agent at the desktop, from a mobilitystandpoint, or directly to the customer. If those foundationalelements aren't there, it doesn't matter where you invest thedollars because it will be very difficult to improve the agentexperience or the customer perspective.”

|John Swigart, chief marketing officer for Esurance,asserts the ascendancy of the direct channel for personal linesproducts has come in response to the consumer's desire to buy andservice insurance policies in an online environment rather than theinsurance industry pushing the technology at the consumers.

“I would say our industry as a whole–particularly theagent-based insurers–is pretty far behind other industries,” saysSwigart.

|Today, customers want the option to interact with their carrieronline or on the phone. They want to be able to performself-service tasks and access information related to theirinsurance needs online and also have the option to speak with alicensed agent or call-center representative to answer anyquestions or concerns, according to Swigart. Esurance has beenselling and servicing policies online for a decade, so Swigartbelieves newcomers to the online world need some time to catchup.

|“From a systems standpoint, to exist in a real-time online worldtakes a lot of infrastructure for the traditional legacy-basedcarrier,” says Swigart. “We've been doing it for a decade, and it'snot even that easy for us, to be honest. It takes a lot of work andeffort, partly because it is an individually state-regulatedproduct and all the states have unique elements we have to complywith. We've built our company around being able to [meet thoseelements]. It's pretty core to who and what we are.”

|But even those with modern systems have to consider the value ofa multichannel direction. Progressive Insurance has spentmillions of dollars promoting its direct sales channel, but thecompany also maintains an independent agency sales force, too.

|“We actually think we are a leader on both sides,” says AlvitoVaz, IT director for Progressive.

|There is synergy in both channels at Progressive, Vaz maintains,particularly in the e-commerce space. “When we do something in onechannel, we quickly can leverage it in the other channel,” he says.“We've seen value on both sides. We feel the ongoing movement tomore electronically connected, Internet-based services is the wavethat is pushing everyone–not just Progressive–and we just happen tobe riding that wave with some of the things we are doing.”

|Mitchell points to the fact Progressive spends an enormousamount of money on brand advertising, innovation, and technologysolutions that drive costs out of the business and connect to theconsumer, yet the majority if its business still is written throughthe independent-agent channel.

|“Everything it invests on the customer side it has to enable onthe agent side, as well,” says Mitchell. “Customers expect the sameexperience whether they are talking to someone on the phone,visiting the Web site, or talking with someone in person. My viewis if you are going to invest in one, you have to invest in theother, or you are going to have a breakdown in the experience.”

|Progressive used to have segregated IT systems for the differentsales channels, but over time, Vaz explains, the company realizedit was doing the same thing multiple times.

|“It really made sense to pull both channels together andleverage one thing,” he says.

|Progressive is not concerned with pushing one side over theother, adds Vaz. “It really comes down to consumer choice,” hesays. “Consumers will buy the way they feel is the easiest.”

|The Internet has made information readily available to shoppersfor all types of products. For example, Vaz indicates, when he buysa car, he will do research on the Internet, but he still will go toa local auto dealership to purchase the product.

|“That's a good analogy to the insurance space, where we see morepeople doing research on options on the Internet, but a lot of themstill are going to local agents because they want to deal with thatperson,” says Vaz. “Some are comfortable going out and purchasingit through the Internet. It comes down to consumer choice. We haveno preference either way. Our goal is to sell more auto insuranceand let the consumers decide how best they want to work withus.”

|As for the agent side, JeffYates doesn't deny things have changed when it comes toconsumer shopping for personal lines products. “Most people todaywhen they shop for insurance look first on the Internet,” says theexecutive director of the Agents Council on Technology.“Therefore, it's important for agents to have a strong Internetpresence and a social media presence.”

|(For more on the direct channel click here and for more on the agency channelclickhere.)

|LEARNING CURVE

|The three pieces of the insurance life cycle–quoting and buying,servicing, and claims–take on a different aspect in the onlineworld, Swigart notes. On the quoting and buying element, hecontends insurers are racing to get ahead of the curve by beingeasier and less intrusive when collecting information from thepotential customer.

|“Is there a way we can extend that kind of agent experience inthe online world?” asks Swigart. “Can we give transparency aroundwhat we are doing? A lot of consumers get frustrated because theydon't understand how companies come up with the rates. Can we helpthem find other options?”

|On the customer-service side, Swigart states carriers need to beavailable to customers in the way the customer wants to interactwith the carrier. That includes offerings such as a 24/7 callcenter and full functionality on the Web site to manage apolicy.

|On the claims side, Esurance allows policyholders to interfacewith the carrier to report and track their claims from their mobiledevices as well as online or by telephone. “We assign dedicatedclaims reps to take them through the process so there is one personthey can deal with,” says Swigart.

|Esurance has a partnership with AutoWatch, which allowscustomers to view pictures of their vehicle and interact with thebody shop on a daily basis.

|“It cuts us out as a middleman in terms of when your car is inthe shop. This allows the shop to be proactive and the customergets more real-time information on when it is going to be ready,”says Swigart.

|CHANNEL CONFLICTS

|Agent-based carriers face difficult issues when it comes tochannel conflicts, Swigart remarks. “We don't face the samechallenges an Allstate or a Nationwide or a company withindependent agents faces when it tries to sell directly,” he says.“The answers companies have come up with haven't been fantastic,although there certainly are no easy answers. The most appealinganswer to the agents sometimes ends up costing the company a lot ofmoney. [Channel conflicts] are much more of a challenge than the ITchallenges of selling directly.”

|The landscape is evolving, but even at Esurance, a classiconline distributor of insurance, Swigart reports half of thecompany's sales are done over the telephone in the call center.

|“We've been as high as 70 percent closing online and 30 percentover the phone, but we decided to move back to being more availableand encouraging consumers to buy however they are mostcomfortable,” says Swigart. “We still drive most of our shoppingtraffic to the Web site, but in terms of how people might want tobuy the policy, we are pretty agnostic as to how they want to dothat.”

|The online experience is anonymous and can be seen asimpersonal, which makes it easier for some consumers to exit theWeb site before the sale is completed.

|“We felt we weren't being as consultative as we could be, and weweren't making it apparent we were available if customers wanted totalk with somebody,” he says. “It's a pretty big purchase online,so we wanted to make sure we were giving them that opportunity andbeing very obvious about it.”

|WHO'S DRIVING THE CHANGE?

|The customers have been pushing for improvement in the onlineexperience for the last 10 years, according to Mitchell, andcertain carriers just now are catching up.

|“GEICOo and Progressive have been able to maintain or grow sharebecause of a simple phrase of following the customer,” he says.“The major insurers–State Farm, Allstate, and Nationwide–realizedthey weren't investing in the technology and the right processesand strategies back in 2005 and 2006 that would enable them todeliver a good multichannel experience.”

|Customers were going to the Web in small numbers in the early2000s, but today the numbers are shifting. “One out of two, andsome people say three out of four, customers go to the Web firstfor research,” says Mitchell. “They don't necessarily buy online,but that customer behavior ultimately influences technologyinvestment.”

|In an interview conducted with Tech Decisions back inJanuary (Turnthe Page: New Year Brings Hope for Economic Recovery), JimKorcykoski, CIO of Nationwide Insurance, pointed out the need forhis company to make changes to adapt to the needs of thecustomer.

|“[Consumers] expect not only to shop and learn about homeowner,auto, and other coverages online but to buy it there and eventuallyservice it, ultimately never touching an agent,” saidKorcykoski.

|In Nationwide's view, there has beena significant increase in the amount of insurance businesscustomers buy direct vs. what goes through an agent's office. “In1985, there wasn't a lot of Internet, and six percent [ofpurchases] was direct and probably most of that was phone,” saidKorcykoski. “In 2007, it was 22 percent, and in 2014, we expect itto be at 30 percent. When you look at our mix of business and askwhere most of our business is coming through, most of it is comingthrough our agents, but our customers aren't saying that's the waythey want to do it. So, we are going to direct a lot of ourbusiness to the direct channel.”

|Investing in the direct channel isn't a tough choice forinsurers. “The primary focus of direct is its efficiency anddriving costs from the business,” says Mitchell. “If you areserving a self-directed customer who starts online, gets a quoteonline, and binds online, the cost per acquisition for that policyand the amortization of the first two to three years is, onaverage, 30 percent lower than agent-based or call-center-basedtransactions. “It's cleaner from the sales and service perspective.There are immediate and long-term ROI gains.”

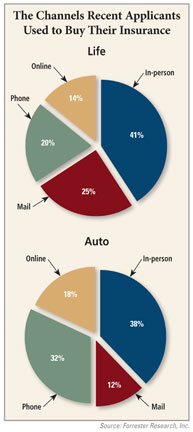

|Still, Mitchell points out data shows the overall U.S. autocustomer and, for the most part, homeowners and life customers wantto purchase their policies through an agent.

|“That's not happening in person as often, but the transaction isbeing assisted by an agent,” he says.

|HELPING AGENTS

|Today, the majority of Progressive's business comes from theagent channel, but Vaz observes the gap closing. To that end,Progressive is working with its independent agents to improve theirWeb presence and adopt the same practices that are available todirect writers.

|“We are exposing them to the effectiveness of our Web site,” hesays. “We are giving them self-service capabilities they can exposeto their customers; we are giving them online capability to give tocustomers coming to their Web site. Those are some of the things weare using to balance things. In our view, it's not one or theother. It's a customer-centric decision, and we want to be able tosupport both pieces.”

|Last summer, Progressive announced it was working with Web sitedeveloper, Web.com to give its agents who don't have a site or areunhappy with their existing site the opportunity to create orimprove their online presence at a discounted price.

|The package for agents includes:

|o A professionally designed Web site with a unique domain.

|o An agent RSS “news feed,” providing regularly refreshedcontent relevant to independent agency customers and prospects.

|o Progressive's real-time agent quoting and servicingbanner.

|o Sixty minutes per month of consultation with Web.comprofessionals for site changes or SEO modifications, and theability to make do-it-yourself changes any time.

|o A scorecard measuring real-time results, including leads inthe form of calls, e-mail, and clicks.

|o Listings on all major search engines and directories.

|Progressive looked through the marketplace to find a vendor topartner with and then rolled in some of the other things thecarrier felt were important, such as lead generation andsearch-engine optimization.

|“We packaged that together so individual agents wouldn't have togo out and do their own research,” he says. “We said, 'Here arethings we find value in, and if you are looking to be more Internetactive, here is a package you might be interested in.' We are notgiving it to them; it's just something we find of value, and wethink they can use it.”

|Vaz is hopeful agents endorse the plan, but he knows, based on20-plus years in the industry, adoption tends to move littleslowly. “We are in an industry where our job is about avoidingrisk,” he says, “but I would be surprised if it is notwholeheartedly taken on by the 30,000 independent agents we workwith.”

|THE FUTURE

|Mitchell anticipates major changes over the next three to fiveyears in the independent-agent space because the Web will become amajor battlefield. “The captive agent has a better chance ofsurvival because of some of the things the corporation is doing,”he says. “The independents have no chance of competing for sharedawareness through interactive marketing. They are not going to beable to spend against GEICO or Progressive or show up in searchresults, because the independent carriers aren't willing to investin that type of search or localized search for the agentchannel.”

|Vaz argues the agency channel will remain strong. “Think back 10to 15 years when some of the disintermediation talk was going onabout how agents were going to be replaced. It still hasn'thappened.”

|An agent's strong local presence in the community adds value,Vaz points out. “When you look at some of the things agents can doaround social media, they really could leverage that local presencemuch more so than the large entities,” he says. “They just haven'tfigured out how to use it effectively. They are small businesses,so it is going to take a little time, but they can certainlyleverage that.”

|From the agent side, Yates doesn't see the role of theindependent agent lessening. “We think once consumers understandtechnology has made [online shopping] an efficient model, when theyunderstand they also can get the local presence and individualcounseling of an agent, they are going to want to use theagent.”

|AGENCY BUY-IN

|Agents need to invest in a comparative rater, advises Mitchell,so they can give the customer multiple quotes, but ultimately theproblem for agents will involve generating leads. “Unfortunately,comparative rater adoption is about 50 percent [among agents].Getting customers on the phone with the agent is going to beeconomically impossible for the independent agent looking togenerate enough leads to sustain the business,” says Mitchell.

|Yates agrees agents need functionality on their Web sites toallow for online quoting. “A number of comparative raters haveincorporated real time in their rating and are extendingfunctionality to the ultimate consumer through the agent's Website,” he says. “That's a positive development.”

|Mitchell contends there will be continued M&A activity forthe large agencies with between 25 percent and 50 percentreductions in captive agent forces.

|“Carriers are going to support only the high-growth agenciesthat are investing in electronic and social media and technology togenerate new business,” he says. “The boomer generation is going tobe pushed out. In five years, I think we are going to look back andsay the insurance agent, particularly the independent agent, isgoing the way of the travel agency, where 80 percent oftransactions are handled for the most part through the Web or acall-center-based transaction, and the only travel agents aroundare the ones who have amassed local or large regional agencies.Commercial lines agents are going to stick around, but your typicalauto/home personal lines independent agency, in my view, is notgoing to be a healthy business in the next five years.”

|Swigart sounds more like a representative of an agents' groupthan a direct writer when he points out the value some customersseek–even in an online setting–when a call center representative isbrought into the mix. “They are there to give advice and counsel,”he says. “There needs to be some threshold of knowledge andaccountability.”

|What will drive success for the future will be a combination oflistening to agents/partners and addressing what is best foreveryone involved in the insurance process, sums up Vaz.

|“If Edison asked people back in his day how they'd like to readbetter, they probably would have said bigger candles that lastlonger,” he relates. “Very few would have said, 'Hey, I want alight bulb.' We have to think outside the box, but we also have tolisten to what the needs are. The combination really drives theindustry.” TD

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.