They Say, Hearsay

|“Given Florida's hurricane problem, I can almost understand whyour homeowners' insurance costs so much. But what's the deal withour auto insurance rates? Florida already has among the mostexpensive car insurance rates in the country, and I hear that ratesare expected to rise. Is the auto insurance market in Florida asmessed up as property insurance?”

|We Say

|Just because Florida's auto insurance market is not sick doesnot mean it is completely healthy. However, there is no comparisonbetween what ails the auto market and what is making us sick overproperty insurance rates. There has been less political interplaywith auto insurance, which is helpful — although trying to make theuse of credit-based insurance scores a cause worth championingseems counterproductive to market wellness. We have other issuesdriving up insurance costs in Florida, such as rising costs formedical care, costly litigation (some of it related toopportunistic fraudsters) and too much traffic.

| Florida drivers pay an average of$1,043 a year on auto insurance, ranking our premiums as the fifthmost expensive in the U.S., just $97 shy of the costliest premiumspaid by drivers in Washington, D.C. (For the lowest auto insurancepremiums, you'd have to move to North Dakota, where your annualauto insurance premiums would drop by more than half.)

Florida drivers pay an average of$1,043 a year on auto insurance, ranking our premiums as the fifthmost expensive in the U.S., just $97 shy of the costliest premiumspaid by drivers in Washington, D.C. (For the lowest auto insurancepremiums, you'd have to move to North Dakota, where your annualauto insurance premiums would drop by more than half.)

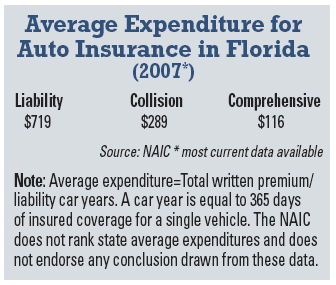

A closer look at how this annual expenditure is divvied up showsthat more than two-thirds of the cost goes to cover liabilitiesassociated with automobile claims. Florida outranks every otherstate, except New Jersey, in the portion of annual premiumscovering liability-related costs. The National Association ofInsurance Commissioners (NAIC) calculates average expendituresunder the assumption that all insured vehicles carry liabilitycoverage but not necessarily collision or comprehensive coverage.The average annual expenditure calculation measures what consumersactually spend on insurance for each vehicle, which does not matchthe sum of liability, collision and comprehensive because not allpolicyholders purchase all three coverages.

|Here's how the NAIC breaks down the costs in Florida:

|Automobile rates are going up nationally as well. The U.S.Department of Labor's 2009 year-end report states that automobileinsurance rates rose 4.5 percent. The consumer price index pointsto rising costs of hospital, physician, and legal fees. Hospitalservice prices increased nationally 6.4 percent in 2009, and feesfor physician services were up 3 percent; legal fees climbed 2.7percent. Then, there is the cost of motor vehicle body work — up3.2 percent last year.

|Florida's urban population and traffic density also drive uppremiums. More people and more cars on fast-moving, big cityhighways equal more accidents. Things really start to add up whenyou factor in the increasing number of uninsured drivers andrampant fraud. The Insurance Research Council estimates that aboutone in four drivers in Florida is uninsured and makes a corollarybetween higher unemployment and uninsured drivers.

|

Florida's challenges with rising auto insurance rates arecompounded by no-fault auto insurance laws that breed organizedgroups seeking a steady revenue stream from staging automobileaccidents and submitting fraudulent and inflated medical claims.The National Insurance Crime Bureau (NICB) reports that the ratioof staged accidents to overall bodily injury claims is increasing —and can you guess which state tops the list for the mostquestionable claims related to staged accidents? Yes, anotherdubious distinction for Florida. According to the NICB, Floridaaccounted for 27.6 percent of all the staged/caused accidents inthe U.S. for the first half of last year, with five Florida metroareas ranked by NICB as Top Ten loss cities: Tampa, Orlando, Miami,West Palm Beach, and Hialeah.

|Despite all that is wrong with the Florida auto insurancemarket, consumers have coverage options, and choices remainavailable and affordable. Plus, risky drivers pay their own way,not taxpayers. If you want to contrast the private and publicmarkets for auto and property insurance, consider this:

|A.M. Best reports there were just 21 policies in the sharedmarket for auto insurance in 2008. In the shared market forproperty insurance, Citizens Property Insurance Corp. had 1,026,597on the books as of January 2010. Health may have a relative value,like so many other things — and relative to property insurance,auto insurance has a better, albeit somewhat debilitated,prognosis.

|Lynne McChristian is the Florida representativefor the Insurance Information Institute. She may be contacted at813-480-6446, [email protected].Also, see www.InsuringFlorida.org forher insurance blog, “Straight Talk.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.