Federal lawmakers may cut a provision of proposed legislationthat seeks to end the antitrust exemption for medical malpracticeinsurers afforded by the McCarran-Ferguson Act exemption, accordingto insurance industry sources.

|Rep. Tom Perriello, D-Va., and Rep. Betsy Markey, D-Colo.,announced the proposed bill at a press conference on Feb. 5, inanticipation of a House vote last week.

| In announcing their plans, the two members said, "It'stime for Washington to decide whether we stand with patients orprofiteering, whether we believe in market competition or collusionbetween politicians and insurance monopolies."

In announcing their plans, the two members said, "It'stime for Washington to decide whether we stand with patients orprofiteering, whether we believe in market competition or collusionbetween politicians and insurance monopolies."

But the bill was never actually introduced that day, or evenlast week, with Congress effectively closed down because of thesnow.

|In a message to its members asking them to call theircongressmen to oppose the bill, the National Association ofProfessional Insurance Agents said it is unclear whether the billwill have the votes to pass, "even if it comes up on the Housefloor. In fact, some industry lobbyists think that a vote may notbe taken if there aren't sufficient votes to pass it."

|Several industry lobbyists said the delay was likely due to thefact that the House Democratic leadership found it didn't have thevotes to pass the bill as originally envisioned, and that they areconsidering removing the med mal provision in hopes of winning theessential votes to pass the bill.

|At the same time, they said it is unlikely that the Senate wouldpass such legislation in any form, especially in the currentgridlocked atmosphere.

|That would be welcome news to property and casualty insurancetrade groups.

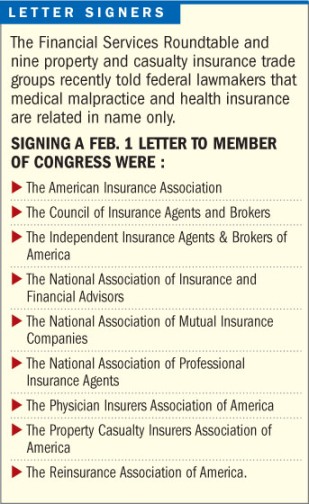

|Days before the Feb. 5 press conference, a group of 10 tradegroups–nine representing property and casualty and medicalliability insurers and the National Association of Insurance andFinancial Advisers–sent a letter to all members of Congress inanticipation that the House would soon vote on antitrustlegislation.

|The letter noted that medical liability insurance is not ahealth insurance product, but is in fact "a property-casualtyinsurance liability product, underwritten by property-casualtycompanies for medical professionals and facilities."

|In fact, the letter said, "the only thing even health-relatedabout medical malpractice insurance is simply its name and the factthat the medical profession and medical facilities purchaseit."

|Moreover, the letter said, "Its inclusion in legislation torepeal McCarran-Ferguson for health insurance is misplaced."

|It also cited a recent Congressional Research Service study thatrepealing the antitrust exemption afforded medical liabilityinsurers could result in "many lawsuits challenging someinsurer-cooperation practices."

|The CRS report added that prohibiting necessary andpro-competitive insurer information sharing could "actuallydisserve consumers and lessen competition between insurancecompanies; e.g., if information sharing were categoricallyprohibited, some small companies that require it could be forced toleave the market."

|The letter added, "Some members of Congress have a mistakenperception that the antitrust provisions of the McCarran-FergusonAct protect anticompetitive activities by medical liabilityinsurers. They do not."

|Specifically, it said, the National Association of InsuranceCommissioners has stated that "no state insurance regulator hasseen evidence that suggests medical malpractice insurers haveengaged or are engaging in price-fixing, bid-rigging, or marketallocation."

|Also welcome news to p&c insurers was the fact that the billunveiled by Rep. Perriello and Rep. Markey does not include aprovision contained in an earlier version providing expressenforcement authority to the Federal Trade Commission with respectto "unfair methods of competition" for all types of insurance.

|In early December, the House passed its version of health carereform legislation, including much more far-reaching language onantitrust repeal, which is opposed by all segments of the insuranceindustry.

|Separately, med mal issues took center stage in the state ofIllinois, in a Supreme Court decision repealing legislative caps ondamages for pain and suffering.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.