While many agents specializing in personal lines cite stabilityand customer retention as the reasons for their involvement withthe line, most who are dedicated to selling personal lines auto andhomeowners share one attribute: they like to help people, which isimportant in a poor economy.

|“I love helping people,” said Celia Santana, CEO and presidentof Personal Risk Management Solutions, New York, who started inpersonal lines 17 years ago. “The fact that Personal RiskManagement Solutions has a singular focus and passion for servingclients in this business really makes a difference in our service.”

“Being successful in this business requires some type ofinvolvement or connection with the community,” said Bruce C.Robins, president of Robins Insurance Agency Inc., Nashville, Tenn.“We work very hard to maintain persistency.”

|These agents are not alone in their focus. Industry statisticsshow that more independent agencies have increased their personallines sales over the past several years. According to the 2008IIABA Agency Universe study, personal lines commissions remain thelargest single source of agency revenue for 45 percent of itsmembers' average revenue, compared with 39 percent for commerciallines.

|The study also indicates that agencies are representing moreinsurers for personal lines, with the average number of carriersfor personal lines (excluding specialty lines) increasing to 6.2per agency in 2007 compared with 5.4 average in 2006. The personallines carrier/agency relationship has improved as well: Overallagency satisfaction with their personal lines carriers was 72percent in 2008, compared with 65 percent in 2006.

|Agents like selling personal lines in large part because of thestability it provides, especially during rough economic times.“Personal lines provides the consistent work flow and revenuethrough good times and bad that allows us to grow and plan for thelong term future,” Robins said.

|And because stability and consistency are key elements forsuccessful personal lines sales, client satisfaction is a toppriority for agencies specializing in personal lines. “Sellingpersonal lines insurance is so important,” Santana said. “Hearingclients' individual stories motivates our staff to delivertop-notch service.”

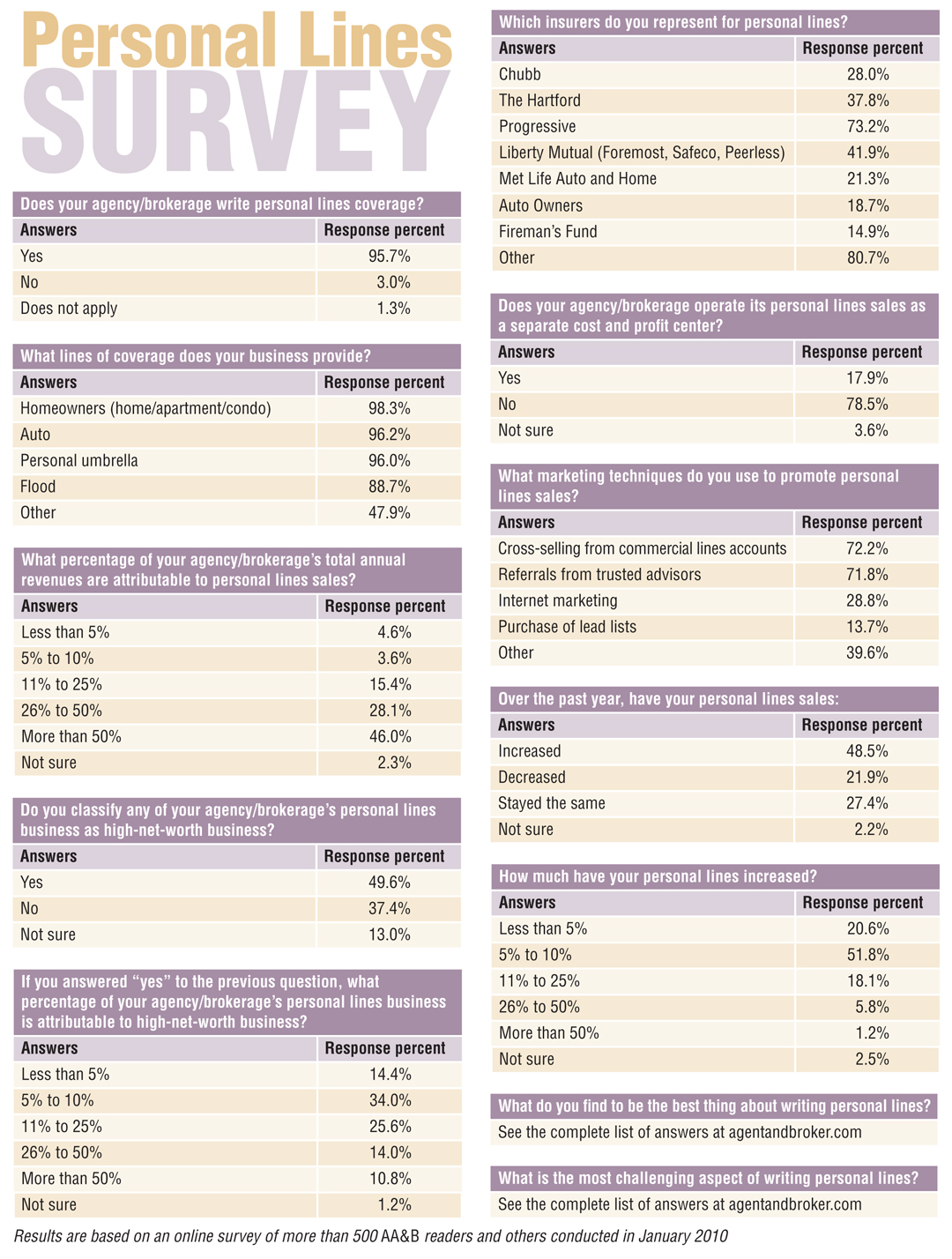

|Because of the personal nature of the transaction, most agenciesstill rely on referrals and word of mouth in marketing theirpersonal lines products and services. The AA&B readersurvey shows that cross-selling from commercial lines and referralsfrom “trusted advisors” like real estate agents and othersaccounted for 72.2 percent and 71.8 percent of their marketingefforts, with only 28.8 percent using Internet marketing. However,most of the agencies we spoke with are in the beginning stages ofincorporating social media and Internet marketing into theirmarketing techniques.

|Although each agency has a different story to tell about theirpersonal lines involvement, most have realized its importance overyears of selling. Here are a few:

| Tim Brenneman managing director,

Tim Brenneman managing director,

Cook Hall & Hyde,

East Hampton, N.Y.

Cook Hall & Hyde, East Hampton, N.Y., is divided into 3 corebusinesses: commercial, personal and employee benefits. With 120 onstaff and approaching $20 million in annual revenues, the agencyhas dedicated sales people in each department. Personal linesinsurance sales comprise about 28 percent of the agency's revenue.“This amount has remained fairly constant over the past 10 years,”said Tim Brenneman, managing director.

|“Personal insurance has been a very stable business. We use ouraccess to a multitude of markets as an advantage in selling andservicing our business,” he said.

|Like many agencies and brokerages, Cook Hall relies on newclient referrals from “trusted advisors” to build its personallines business. “In terms of personal insurance marketing, ourprimary thrust is to develop key relationships with advisors andother centers of influence like wealth managers, financialplanners, accountants, realtors, mortgage brokers and otherprofessionals,” Brenneman said.

|In addition, the agency maintains contact with its clientsthrough the Internet. “A couple of our sales people have builttheir own blogs to enhance communication with clients and centersof influence,” Brenneman said, “but I do not think we can say theyhave brought in extra sales.”

|Cook Hall & Hyde's top carriers include Encompass, Chartisand Chubb. The relationship with each insurer is solid, which makesfor more sales. “We have more than $2 million of volume with eachcarrier and generally try to get our key carriers to the $2 to $3million premium range to maximize our relationship and ease ofbusiness,” Brenneman said. “At that level we are important to themand our sales and service team accesses each company enough to makebusiness work better.”

|Cook Hall focuses on homeowners, auto, home business, flood,watercraft and personal umbrella insurance. It also offers apersonal insurance package that combines coverage for homes,automobiles, excess liability and boats under one policy. “We havean active cross selling and coverage upgrade program within ourservice team that generates an additional $1 million of premiumeach year,” Brenneman said.

| Bruce C. Robins president,

Bruce C. Robins president,

Robins Insurance Agency Inc.,

Nashville, Tenn.

“When I started from scratch in 1976 I was a relative newcomerto Nashville, so writing personal lines and small commercial wasall I could do,” said Bruce C. Robins, president. “Much of this newbusiness came from real estate agents who I called on prettyaggressively.”

|The agency began to develop while adding sales and support,which started growth for the company. Today, 45 percent of theagency's $20 million in premium volume comes from personal linessales. “This figure has not varied very much in our entire agencyhistory of 33 years,” he said.

|Robins explained that community involvement–including the Web–isessential in succeeding at personal lines sales. “Being successfulin this business requires some type of involvement or connectionwith the community and social media plays very well into thisobjective,” he said. The agency uses Facebook to not only blastnews to its “friends,” but agency producers also use Facebook as aprospect tool.

|“As our agency has more than 10,000 policies in force, we workvery hard to maintain a normal 89 percent persistency of renewals.This means we must write more than a thousand new policies per yearjust to stay even,” Robins said. To retain customers, the agencysends eblasts and CSR staff serve their assigned accounts.

|Robins and his 23 employees are making a conscious effort toacquire new accounts by targeting families in their 20s through40s. “As we continue to add a new generation of producers, weshould be able to continue to capitalize on this excellent market,”he said. The agency's philosophy is to build its relationships withits clients while they are young. Those in the 20 to 40 age groupoften include small families with children, people starting abusiness or opening a practice or those moving into management.“It's the best time to build alliances,” Robins said. “As peopleget older, they are more set in their ways, families shrink as kidsgrow up, and business relationships tend to be moresolidified.”

| Jeff Cox

Jeff Cox

president,

Lloyd Bedford

Cox Inc.,

Bedford Hills, Conn.

Lloyd Bedford Cox Inc. (LBC) is a third-generation family agencythat was founded in 1921. Approximately 10 years ago it began tocarve out commercial lines and today is completely dedicated toselling and servicing high net worth personal insurance. “Inspecializing in the high net worth arena, our strategy was to onlydeal with the top carriers, primarily for claims reasons,” saidJeff Cox, president. 100 percent of LBC's revenue comes frompersonal lines. Cox declined to reveal agency revenue figures.

|LBC specializes in selling homeowners, auto, umbrella,watercraft and other personal lines insurance, focusing onproviding value to clients by only dealing with carriers with thehighest integrity. “We have found personal lines to be the mostconsistent of all lines of business,” Cox said. “This consistencyallows us to run leaner than many competitors while still providingan exceptional level of service.”

|Marketing plans for this agency revolve around referrals,existing clients and trusted advisors. “The market has been slow,especially in 2009,” Cox said. “A lot of clients and prospects havehad their attention elsewhere, primarily due to turmoil in thefinancial markets. Toward the end of 2009 we had more clients doingcomplete reviews of their policies and acquired some largeraccounts whose existing agents failed to complete adequate reviewsfor them.”

|The agency is focused on long-term growth. “We market today forgrowth in 3 years, or 5 years, or 10 years,” he said. “We market byadhering to a higher standard of service than our competitors andas a result, clients refer friends and colleagues,” The agencyplans to double its business every 5 years.

|As for the economy's effect on the company, Cox firmly believesthat LBC is weathering the storm. “There aren't a lot of homesclosing right now and our company is doing complete reviews forclients. We are very equipped to handle the market,” he said.

|About 80 percent of this agency's clientele is serviced byChubb. “Chubb's service is fantastic,” Cox said. “Chubb's serviceis largely provided on the merits of an account, not based solelyupon rigid underwriting standards. If a client deserves anexception, they don't hide behind the rule like most othercarriers, they provide the exception.Chubb specializes in initialappraisal service that is done for every home on site.” Cox alsobelieves that Chubb offers great service based on the ease andspeed with which they issue policies and their settlement ofclaims.

| Bob Loiselle

Bob Loiselle

president,

Loiselle Insurance Agency,

Pawtucket, R.I.

“75 percent of our revenue comes from personal lines, which hasbeen stable over the past several years,” said Bob Loiselle,president of Loiselle Insurance Agency, Pawtucket, R.I. Loiselledeclined to reveal agency revenue figures. “No one client accountsfor a large portion of our revenue which is why we havestability.”

|Loiselle specializes in auto, homeowners and business insurance.Loiselle says that his agency has stable insurance carriers whichoffers the opportunity to meet a clients needs immediately.Offering this kind of service helps to maintain this level ofpersonal lines sales.

|Loiselle's agency represents 20 insurance carriers including itstop personal lines carriers: Safeco, Progressive and Travelers.

|Marketing techniques include print media, direct mail, cable TVand the Internet. Loiselle says the Internet is becoming a majorfactor in marketing whereas print venues like the Yellow Pages area diminishing factor.

|Loiselle Insurance Agency has been serving consumers for 65years. Loiselle believes that the agency's future is very bright.“Once clients realize that we offer them choice of carriers, choiceof coverage, advocacy, and personalized attention that is all apretty tough combination for others to beat,” he said. Loiselle'sstrategies for the future include “building a strong personalizedagency that allows us to maintain profitability.” As for Loiselle's5-year plan, the agency is focusing on slow and steady growth andany potential acquisition.

| Celia Santana

Celia Santana

CEO/president,

Personal Risk Management Solutions,

New York

At PRMS, personal lines aren't just a sideline; they're thewhole story, because high-net-worth personal lines business makesup 100 percent of the agency's revenue. “Every single client issomeone who is talking to us about their personal assets,” Santanasaid. “This is our agency's focus and passion.” Santana declined toreveal agency revenue figures.

|With Chubb, Ace and Chartis as its top carriers, PRMS' closerelationship with its companies results in clients receiving thebest service the company can offer. “All our carriers are focusedon high-end clients and delivering top-notch service,” Santanasaid. “This is what it's all about. You want to work with a companythat is going to offer fair hassle-free settlements.”

|An example of this kind of service is when a client of PRMSsuffered a fire at her home. “The home was a beach house that hasbeen enjoyed by 3 generations in her family and so there's atremendous emotional connection to this home. They were devastated.We were able to help them get paid quickly and fairly by theinsurance company [Chubb] and they were thrilled,” Santanasaid.

|Along with the advantage of stability that selling personallines offer, there are some challenges that come with thisbusiness. “Our biggest challenge is getting people to want to focuson their insurance,” Santana said. “Our clients would rather have aroot canal than find the time to talk about their insurance.”

|Another challenge that PRMS has faced is the effect from theeconomy. “Right now, because of the economy, people feel morevulnerable. If there is an opportunity to decrease expense, peopleare more motivated to do so,” Santana said. “Our revenues have notsuffered because of the economy. In fact, we find that in today'seconomy, more people are focused on making sure they have the rightcoverages at the right price.”

|

Additional questions on personal lines:

|1. What do you find to be the best thing about writing personallines? Answers included:

a. Loyalty of clients.

b. Saving clients money.

c. Stable revenue source.

d. Universally accepted by prospects.

e. Easy quoting.

f. Stability in an unstable economy.

g. Easier to cross/sell for combining coverages.

h. Less stress.

i. Providing a service to meet people's needs.

2. What is the most challenging aspect of writing personallines? Answers included:

a. Competition within the industry.

b. Rate changes.

c. Customers only want to compare price, not coverage.

d. Time.

e. Expanding opportunity to quote more accounts.

f. The ever increasing requirements by companies and mortgagebanks.

g. The high volume required because of low commissions.

h. Maintaining a profitable loss ratio with storms andattorneys.

i. Current economic climate, pricing and carriers taking rateincreases.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.