The property and casualty insurance industry is expected to seean underwriting loss for 2009, with no let-up in the soft marketthrough 2010–barring a substantial market shift, Fitch Ratingspredicts.

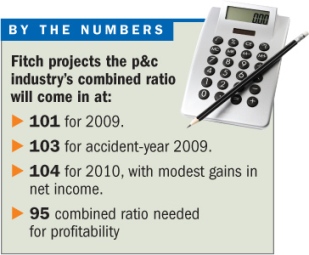

|In its recent report–”Review and Outlook 2009-2010, U.S.Property/Casualty Insurance”–Fitch projects the p&c industrywill come in with a combined ratio of 101 for 2009 and anaccident-year combined ratio estimated at 103.

|Fitch continues to give the industry a “Negative” rating despiteimprovements in the industry's investment portfolio and the lack ofsevere catastrophe losses.

| Julie Burke, managing director and head of North AmericanInsurance Ratings, said during a conference call that last year'smove to “Negative” reflected the onset of the economic crisis andits impact on the industry. She said 45 percent of insurers andreinsurers that Fitch rates have been downgraded, and the majorityof the insurance groups Fitch rates are either negative or on“Ratings Watch.”

Julie Burke, managing director and head of North AmericanInsurance Ratings, said during a conference call that last year'smove to “Negative” reflected the onset of the economic crisis andits impact on the industry. She said 45 percent of insurers andreinsurers that Fitch rates have been downgraded, and the majorityof the insurance groups Fitch rates are either negative or on“Ratings Watch.”

Moving the industry back to “Stable,” she said, would requireconfidence that the financial crisis has passed and that there isno new impact to insurer earnings. She said this analysis impliesthat some insurer ratings will need to move to “Negative” before anoverall “Stable” rating is given.

|James B. Auden, managing director of insurance for the p&csector at Fitch, said the industry is solidly entrenched in a softmarket and this could be a prolonged cycle–though not be as severeas past cycles.

|He said Fitch projects that for 2010 the industry will see acombined ratio of 104, with modest gains in net income. Mr. Audennoted that for the industry to return to underwritingprofitability, it will need to record a combined ratio of 95.

|When asked by National Underwriter about a widelyreported assessment by Todd Bault, an analyst with Sanford C.Bernstein, that American International Group has an $11 billionreserve deficit, Mr. Auden said that while he has not seen thereport in question, he does believe AIG has suffered a lot ofunfavorable developments.

|However, because of the government backing of AIG, Fitch is notconcerned any deficit will have an impact, he added.

|Ms. Burke noted that as AIG's ownership moves back into theprivate sector, a reserve deficit could have a negative impact onthe ratings.

|Regarding the reserve picture of the industry as a whole, Mr.Auden said insurers are in a strong position thanks to the hardmarket of 2003 through 2006. However, as the current soft marketplays out, reserves would be scrutinized more closely.

|“They are adequate now, but we are watching,” he noted.

|Mr. Auden said he believes the current soft market will continuethrough 2010 as capacity remains strong and competition intense. Asevere market dislocation–such as severe catastrophe, major companywithdrawal or merger–could profoundly change the market'sdirection, but he said he does not see that happening in the nearterm.

|Meanwhile, an analyst with Celent said he is even morepessimistic about the industry than is Fitch.

|In an interview with National Underwriter, MikeFitzgerald, senior analyst with Celent–a Boston-based financialresearch and consulting firm–said he is more negative when it comesto rating the p&c insurance industry, explaining that the issuewith this soft market cycle is that there is “too much capacity.That's the problem.”

|In a statement, Mr. Fitzgerald said, “the 'Negative' ratingoutlook issued by Fitch Ratings for U.S. property and casualty iswarranted and, in addition to the pricing and demand concernsmentioned in the press release, there are loss and expensepressures which should dampen expectations.”

|He added that “on the loss side, the earned premium flowingthrough results in 2010 will reflect the full effect of theeconomic downturn and the lower premiums gained throughout 2009.Even given 'normal' loss levels, this earned effect will increasethe loss portion of the combined ratio.”

|Fitch projected that for 2009, the p&c insurance industrywould run a combined ratio of 101, increasing to 104 for 2010.

|Price hardening will come after a long soft cycle, Mr.Fitzgerald said, as companies find single-digit returns no longeracceptable. Without a major catastrophe, he explained, there willbe no near-term change in insurance market rates. It will take an“act of enlightenment” before insurers end “the long, hard slog ofthe soft market playing out” today, he told NU.

|“On the expense side, written premiums will increase in linewith a general economic improvement, but will not recover to thelevel needed to spread the largely fixed expenses facing insurersin 2010,” he said in his statement. “Most expenses will be fixedbecause the downsizing actions available to most insurers in 2010will be limited, since most actions will have already been taken,so 'shrinking to greatness' will not be an option.”

|Insurers will also need a pick-up in demand for insurance thathas been depressed due to the economic crisis, he told NU.The industry will lag behind the rest of the economy, he suggested,noting that such a pick-up, which would reduce capacity, will nottake hold until 2011.

|He said that another price driver–reinsurance–has so far not hadan impact on the insurance market because primary carriers areabsorbing the cost of increased reinsurance rates to avoid the lossof markets.

|Insurers have practically wrung-out all they can on the expenseside, according to Mr. Fitzgerald, and if they cut further theyrisk jeopardizing service and not being in a position to respondwhen the opportunity comes to grow, he said.

|Mr. Fitzgerald added that he doesn't expect a shift to ahardening market to begin until after the first half of 2010 at theearliest, and may become more entrenched by the beginning of2011.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.