Placing a client's risk with a carrier that you trust will bethere when a claim must be paid should be the paramount concern ofevery agent and broker. Yet some producers seem to forget this whenit comes to buying their own errors and omissions coverage.

|For some members of the Professional Insurance Agents ofFlorida, failing to do their homework proved to be a major error injudgment and underscored what they tell clients–let a professionaldo the work.

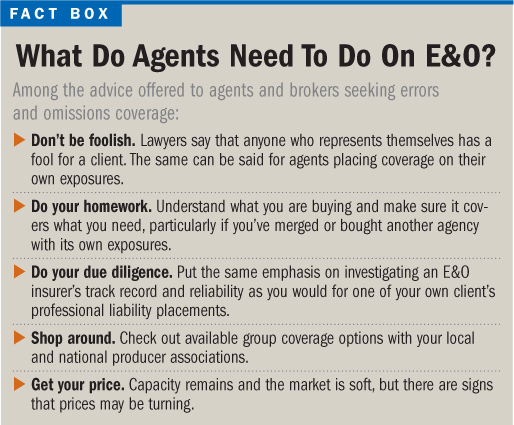

|“We are telling agents, make sure you do your due diligence.Investigate the carriers just like you would do for yourcustomers,” said Jeanie Hardy, E&O agent for the PIA ofFlorida.

|The lesson came home with the loss of two E&O coverageresources in the Sunshine State, with one carrier turning out notto be an insurer at all.

|With cheap premiums, a number of agents placed their E&Orisk with E&O of America, reported Ms. Hardy. The only problemwas that this wasn't an insurance company. The outfit turned out tobe a risk retention group based in Colorado that stopped answeringthe phones. Its closing produced a scurry of activity for thoseagents to find substitute E&O coverage.

The second carrier–First Commercial Insurance Group–went intoreceivership on Aug. 24. The regulator, the Florida Department ofFinancial Services, canceled the agent E&O policies, forcingagencies to scramble for coverage to stay in business.

|The department warned agents with First Commercial, but agentswith E&O of America never got notices.

|“They [agents] had no clue until they tried to contact thecompany–it was scary for them,” said Ms. Hardy. “You don't expectto see that in the insurance industry, but it happens.”

|The agents caught in this bind were primarily young agents newto the business, according to Ms. Hardy. They also suddenlydiscovered the difference between claims-made and claims-reportedE&O coverage.

|A claims-made policy provides coverage for claims filed duringthe life of the policy–even if those claims were prior to the dateof coverage, unless otherwise excluded. A claims-reported policycovers only E&O claims events that occur during the policyperiod.

|The lesson, she said, is that “it might seem like a great ideato place your own [E&O coverage], but it is better to go tosomeone who does it for a living.”

|Luckily, finding coverage in Florida, she said, should not posea serious problem. The admitted markets have pulled back primarilybecause of the E&O exposures agents face on coastal risks. Thissituation is not confined to Florida, she said, but the “surpluslines are active and aggressive” in this market.

|Advice to place coverage through a professional was no less trueat PIA Connecticut, New Hampshire, New Jersey and New York, whereShawn Buicko, director of member services for the four stateassociations, said markets are amply available and competition ison the upswing.

|The soft market and recession are keeping premiums low, shesaid. Premiums tied to revenues have declined because agencies havelost clients in the bad economy. It helps that competition remainsamong carriers, she added.

|Ms. Buicko advised that agents seeking to cut their premiumsfurther should consider taking loss prevention seminars to receivecredits that will help lower rates.

|Ms. Buicko insisted that it is vital for agents to read andunderstand their policies and know the extent of coverage–includingdefense coverage, limits and deductibles.

|Some policies may not have sufficient tail coverage, shewarned–a vital point when an agency makes an acquisition and needsto cover events extending beyond a one-year period.

|The market for agent E&O is surprising because pricingremains below what is historically indicated, according to SabrenaSally, senior vice president for Swiss Re Insurance Corp. The lossof investment returns for insurers would indicate the need forhigher prices to bolster underwriting profitability. Instead,competition is keeping prices lower than what would be expectedunder the circumstances, she explained.

|“It is surprising to see that activity, especially among those[insurers] that want to remain long term,” Ms. Sally said.

|Mark Wolf, program leader for the Independent Insurance Agentsand Brokers of America professional liability program–which isunderwritten by Swiss Re's Westport Insurance Corp. that Ms. Sallyheads–said some of the pricing in the market is clearlyunsustainable, and current rates cannot pay futureclaims.

“There is no rhyme or reason to this,” he said. “It's almostlike some companies are lowering their prices to grab market sharein anticipation that they will raise rates fairly quickly. That iswhat we have all come to the conclusion about.”

|Ms. Sally called that a risky strategy–one which Swiss Re is notfollowing. “Our approach is to price soundly for what we expect theexposure to be,” she said.

|The partnership between IIABA and Swiss Re goes back 23 years,the executives noted, and Mr. Wolf said it has been sustained withremarkable loyalty by the agents and brokers.

|“It is very important to understand that we have a premiumproduct in the marketplace and we think agents value that product,”he said.

|The long-term success of IIABA's E&O program is itsattention to risk management, according to Mr. Wolf–something hesaid the program spends a lot of time on with its members tocontrol losses.

|One growing exposure that has changed in the past eight yearsconcerns mergers and acquisitions, noted Ms. Sally. Becauseagencies are expanding into other states, they need to be aware ofhow professional liability standards can differ from state tostate. That differentiation in standards can have a bearing on theliability coverage needed, she noted.

|For Liberty Mutual Group's Liberty International Underwriters,the company has kept its rates in check despite what Ross Herlands,vice president of professional liability, sees as a very soft andcompetitive market. Lately, he noted, there has been a subtlechange in direction.

|“Price is still soft, but you are seeing pockets of increase,”according to Mr. Herlands. “We have always maintained our patienceto hold the line at what makes sense and not follow the marketdown.”

|He said there has not been a dramatic change in loss trends inthe past couple of years on the property and casualty side of thebusiness. “We're starting to see more discipline,” he said of theE&O marketplace. “We want to be hopeful about that.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.