First-half 2009 financial results for property and casualtyinsurers and reinsurers in Bermuda saw two of the smallest players“moving on” after failing to bulk up with a second-quarteracquisition, and demonstrating stronger premium growth than theirBermuda counterparts.

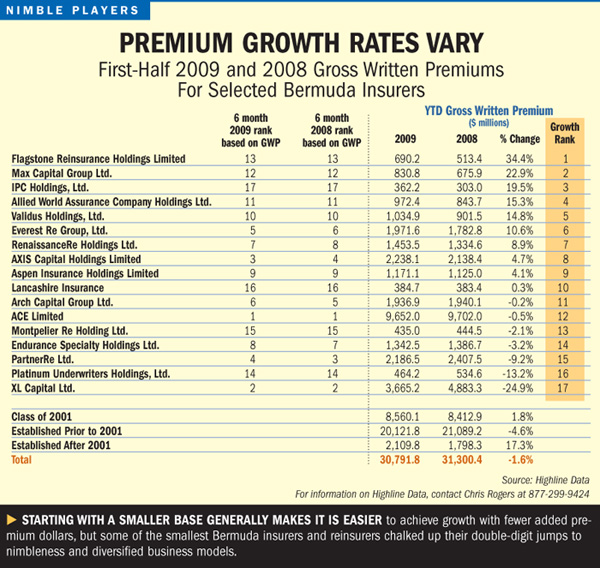

|According to statistics compiled by NationalUnderwriter for 17 publicly traded companies created inBermuda, Flagstone Reinsurance Holdings and Max Capital Group–whichhave the smallest capital bases of the group–reported the largestjumps in premium for first-half 2009 over the same period in2008.

| While growth measured from asmall starting base will be numerically easier to achieve thangrowth from a larger one, six other companies among the 17 reporteddeclines, and the group collectively reported a 1.6 percent drop ingross written premiums in the first six months of 2009.

While growth measured from asmall starting base will be numerically easier to achieve thangrowth from a larger one, six other companies among the 17 reporteddeclines, and the group collectively reported a 1.6 percent drop ingross written premiums in the first six months of 2009.

In contrast, first-half gross premiums for Flagstone shot up34.4 percent to $690 million, while Max Capital reported a 22.9percent jump to $831 million on its top line.

|Flagstone and Max were both engaged in a public battle toacquire monoline property-catastrophe reinsurer IPC Re, but IPC'sboard ultimately voted to go with Validus Holdings in July forroughly $1.6 billion.

|The two losing bidders, with jolts from 2008 deals for Lloyd'svehicles boosting their premium volume levels this year, werehardly licking their wounds as they responded to analysts'questions on earnings conference calls earlier this month.

|“Clearly there's a lot more commentary today on scale [now] thanthere has been [in the past], and we probably promoted a lot ofthat as we entered into the IPC transaction,” said Marty Becker,Max's chair and chief executive officer, referring to statements hemade back in March in support of an IPC merger, touting thebenefits of a deal that would have created a company with more than$3 billion in shareholders equity.

|Since then, analysts have predicted more mergers in the Bermudamarket, circling around that $3 billion figure as the magic numberin terms of capital required for a relevant participant.

|Flagstone Chair Mark Byrne said $3 billion is “a completelyartificial number, and my guess is whoever said that is somebodywho's got $3 billion. When they have $4 billion, they'll say it hasto be $4 billion.”

|Mr. Becker said that “most of that commentary is futuristicbecause at the moment,…we continue to have very nice growth ratesin a market that's not growing that much.”

|

In particular, he noted that Max's mature Bermuda and Dublininsurance and reinsurance platforms–which he described as “probablythe best representation” of Max's growth potential–continued toexpand, as new platforms in U.S. specialty business and at Lloyd'sadded more volume.

|Max's financial statements reveal that gross premiums for themature businesses grew by 10 percent overall to more than $550million for the first half. In addition, newer U.S. specialtybusiness grew 85 percent to $150 million, while the Lloyd'splatform, added with the November 2008 acquisition of ImagineGroup, put another $90 million of gross premium on the books.

|“Aspirationally, there probably is some benefit to scale, but interms of hard reality of facts at the moment, it would be hard tosupport that,” Mr. Becker said.

|Likewise, Flagstone aspired to be bigger, making a single $1.8billion bid for IPC just before shareholders met to vote on a deal.While the prospect of a larger capital base remains appealing, it'shardly essential, according to Chair Mark Byrne.

|“I think it's mostly nonsense that a $1 billion company is not ameaningful player in this marketplace,” he said, noting thatFlagstone grew its top line by over 90 percent in 2007, and by morethan 30 percent in 2008 and 2009.

|“That doesn't seem to be the growth pattern of a company that'shaving trouble getting clients to accept its name,” he said duringa conference call, during which other executives described growththat came mainly from the Lloyd's platform–Marlborough UnderwritingAgency, which was acquired in October 2008–and double-digit priceincreases in Florida catastrophe reinsurance business.

|“We think the reasons given for turning down our [IPC] offerdon't make sense. But we've moved on and we think we'll find betteropportunities in the future,” Mr. Byrne said.

|Also addressing the capital question were executives from two“Class of 2001″ Bermuda companies formed in the wake of the Sept.11 attacks–Chris Harris, CEO of Montpelier Re, and Michael Price,CEO of Platinum Underwriters. Like Max and Flagstone, thesecompanies each have less than $2 billion in capital.

|

“Generally, size in isolation is not something that drivesclients in their selection of a reinsurer. They want security,quality, service and commitment,” said Mr. Harris of Montpelier,which writes both reinsurance and specialty insurance throughBermuda, London and U.S. operations.

|“Our current size suits our specialist business model well, andwe enjoy an established franchise in our corner of the market,” hesaid, adding that clients “value diversity in theircounterparties.”

|“Business flow is very strong right now. We haven't seen anyevidence that bigger is better,” he said–noting, in fact, that thecompanies that have been struggling over the past year are largeones. “They weren't focused, specialized and stuck to theirbusiness models,” he added.

|Platinum's Mr. Price said that “if you have significantconsolidation, that takes away choice” from clients and brokers,making the argument that insurers are looking to spread reinsuranceplacements to avoid concentration with any one reinsurer.

|Mr. Price also noted that Platinum operates exclusively as areinsurer, while competitors have mixed insurance and reinsurancemodels. With nearly $2.0 billion in capital, Platinum is actuallybigger when more accurate comparisons to competitors areperformed–compared to competitors' reinsurance platforms inisolation.

|“I think, in fact, size can sometimes work to yourdisadvantage,” he added. “You lose nimbleness. You lose the abilityto be selective in portfolio construction, and it's just harder tosay no because you're got to put this capital to work.”

|“Frankly, I believe larger companies are harder to manageeffectively,” he said, highlighting Platinum's ability to easilymove in and out of profitable market segments with quickunderwriting decisions. “You can do that with 150 people. It's hardto do with 1,000.”

|Mr. Byrne, however, has said that one reason for pursuing theIPC deal was to put a very efficient operating engine of 37experienced underwriters and “the biggest supercomputer in theindustry” to better use.

|“A great deal of investment has built a funnel [that] couldeasily process and write twice as much business as we have,” hesaid, adding that the IPC acquisition would have allowed Flagstoneto spread its significant investment in infrastructure andtechnology over a larger capital base.

|Mr. Byrne also admits that with a larger capital base, Flagstonewould have the luxury of not having to take capital away from oneopportunity to pursue another.

|“If we want to write more property-catastrophe in Floridabecause we think the pricing is extremely attractive this year,which we did, we had to do less of something else,” he said, notingthat commercial aviation was the segment Flagstone chose to takecapital away from.

|At Validus, CEO Ed Noonan said the IPC deal–vaulting its capitalposition from just over $2 billion to roughly $3.4billion–positions the company to go after whatever business itdesires. He was among several Bermuda executives who said hiscompany is eyeing the aviation insurance opportunity which willlikely emerge at year's end when the majority of contractsrenew.

|In the wake of some significant air losses, he predicts rateincreases as high as 20-to-30 percent. “Our combined capitalizationwill position us to allow our non-catastrophe lines, particularlyenergy and aviation, to grow and seize the opportunity that wesee,” he said.

|During first-half 2009, non-cat business, accounting for 75percent of Validus' book, drove most of its growth in premiums andearnings, he said, adding that steps taken last year to enter theonshore energy insurance market and to write in Latin America andAsia fueled even more growth.

|According to the company's financial statements, theBermuda-based reinsurance operations of Validus Re and London-basedTalbot insurance operations both had double-digit premium growth inthe first half, together pushing total gross premiums up nearly 15percent to over $1 billion.

|Referring to the overall benefits of the IPC deal, Mr. Noonansaid that “we see this as a truly transformational move. Ouranalysis shows that we can significantly increase underwritingmargins in the IPC portfolio while simultaneously reducingvolatility,” later explaining that Validus had “done significanthedging” as wind season approached in anticipation of the deal.

|With the deal, “we become one of the largest global catunderwriters with better access to business [and] a lead positionon any deal we seek,” Mr. Noonan said.

|“Bottom line,” he said, Validus has “market positioningpost-acquisition that will allow [us] to continue to grow at a muchfaster rate than the market in a very strong rate environment.”

|Patrick Thiele, CEO of Partner Re–which did the largest deal ofthe quarter, acquiring PARIS RE for $2 billion and creating acompany with a capital position of over $6 billion–has a seeminglydimmer view of the overall rate environment.

|“Going forward, we expect a continuation of the market we'recurrently experiencing. By that I mean some lines are improving,some are broadly stable, while others are still declining. Overall,it's profitable stagnation,” Mr. Thiele said.

|A worldwide global recession continues to put pressure onexposure levels, in turn putting downward pressure on insurancecompany written premiums, said the CEO of Partner Re, that beforeits deal wrote more than two-thirds of its reinsurance business ona proportional basis.

|“Reinsurance pricing is at adequate levels overall,” hecontinued, “but certainly there is no marketwide lift-all-the-boatshardening going on. The only improving areas are those thatsuffered significant losses over the past year,” he said, citingU.S. catastrophe and aviation.

|“Looking forward, it is increasingly apparent that we are goingto be in the environment of profitable stagnation through Jan. 1,2010 renewals and perhaps beyond,” Mr. Thiele concluded.

|He also noted that for three years running, Partner Re's actuallosses have come in much lower than expected, but there is “noguarantee that favorable loss returns will continue into thefuture,” he said.

|(Partner Re and most other Bermuda companies continued to takedown loss reserves for prior years during the second quarter,although the magnitude of individual takedowns tended to be lowerthan takedowns in 2008.)

|“We still expect some acceleration of casualty loss frequencyand severity over the next few years as the economy recovers andinflation increases from the current depressed level, but probablynot enough to cause a broad market turn or subsequent easy growthopportunities for all market participants,” he said.

|“That's the context for the PARIS RE acquisition,” he said. “Theacquisition will position us well both in terms of capital anddiversification, but also in terms of competitive positioning andpotential profitable growth.”

|When the deal was announced on July 6, the companies noted that,among other benefits, the combination enhances Partners alreadydiversified book by shifting the mix slightly toward short-taillines in the near term, increasing the amount of non-proportionalbusiness and producing a more meaningful footprint in emergingmarkets.

|In the first half, Partner Re's bottom line benefited from a lowlevel of large losses, favorable loss reserve development and animprovement in the global capital markets.

|The same factors impacted the results of much of the rest of themarket, but Partner experienced the largest year-over-yearimprovement with a more than $400 million swing in investmentresults–as over $200 million in realized and unrealized investmentlosses last year reversed to a similar level of gains in 2009'sfirst half.

|See additional Web-only chart: First-Half2009 Financial Results For Selected Bermuda Insurers

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.