With a firm belief that technology functions best when everyonefeels hardware and software systems are working for them–ratherthan the other way around–RCM&D set out to implement techsolutions that would not only streamline the labor-intensive salesprocess but also promote teamwork and collaboration.

|It was this collaborative approach toward transforming not onlyits systems but its underlying culture as well that earned the firman Honorable Mention in the “2009 NU Agency Technology AchievementAward” program, run in partnership with the ACORD LOMA InsuranceSystems Forum, taking place in Orlando this week.

|

“Because of the complex and competitive nature of the commercialinsurance industry, as well as the challenges of the currenteconomy, it's more important than ever that we retain our currentcustomers, drive organic growth, increase sales, shrink margins,and do more with less,” the agency said in its award essay.

|The need for better tech support was clear at the Baltimore,Md.-based agency, which has five offices in three states, butincorporating a new system was no slam dunk, and not just becauseof the firm's jumbo size. (RCM&D produced $450 million inpremiums last year–$264 million from commercial lines, $80 millionin personal lines, and $106 million in life and healthbusiness.)

|The challenge, according to Ken Runne, chief information officerat RCM&D, was getting salespeople to commit to a new techplatform that would put critical information at their fingertipsand harness their collective brainpower–but while alsounderstanding that they did not want to simply give away theirlifeblood, which is individual databases of contacts.

|Mr. Runne said the agency did not want to fall into a trap wherethey “dump technology on people” in hopes it will gain themsomething. He said RCM&D wanted its work force to buy into thecultural shift the agency was looking to achieve.

|Essentially, the essay noted, the goal was to find a technology“that was a selling tool, not a management reporting obligation”for the sales force.

| RCM&D selected an SaaS(software as a service)-based solution powered by Austin,Texas-based tech provider ProspX. Though the process was startedjust six months ago, the essay noted that RCM&D has alreadyshortened sales cycles, closed more deals, and strengthened clientand carrier relationships.

RCM&D selected an SaaS(software as a service)-based solution powered by Austin,Texas-based tech provider ProspX. Though the process was startedjust six months ago, the essay noted that RCM&D has alreadyshortened sales cycles, closed more deals, and strengthened clientand carrier relationships.

The essay calls the agency transformation “Commercial Insurance2.0.”

|When searching for the right technology solution, RCM&D saidit wanted a platform that would allow for contact management,opportunity management, and relationship and informationsharing/collaboration.

|For example, Mr. Runne said, when a salesperson is about to makea call to a potential customer, they should be able to accessinformation on the prospect–such as whether anyone has previouslyreached out to the company, who the contact is, and what is knownabout that individual and their organization.

|RCM&D considered a number of options, Mr. Runne said,including vendor-provided solutions and out-of-box products–whichwere rejected, he noted, because the agency wanted the ability todevelop and build custom reports.

|RCM&D–a member of the Assurex Global network–said theagency's president saw a presentation during an Assurex annualmeeting where ProspX demoed its product. After checking out otheroptions, the agency chose ProspX as its vendor, Mr. Runne said,because it was able to provide a customizable platform thatsatisfied RCM&D's “hunger for information and numbers,” whilealso allowing for custom reports suited for a salesperson'sneeds.

|A salesperson, Mr. Runne explained, gets a whole history reportfor a contact, not just a notification that a call was made to anindividual at the firm. Data includes what was tried in the past tomake a sale, and suggestions on what to do in the future, such astypes of coverage sought, pricing, etc.

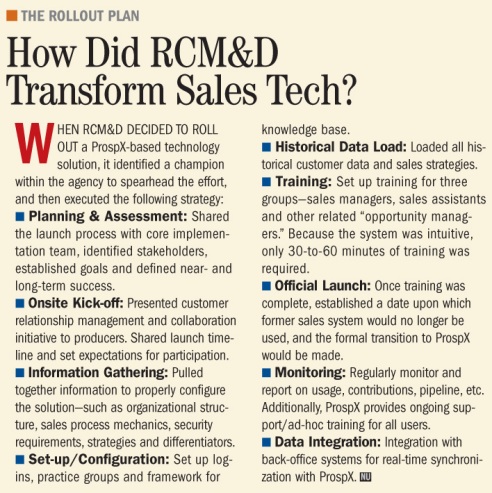

|The essay noted that when implementing the solution, RCM&Didentified a “champion” within the agency to “spearhead theinitiative and oversee the implementation, internal communication,etc.” The subsequent roll-out plan took approximately three weeks,the agency said.

|The process of aggregating all of the relevant agencyinformation was time-consuming, Mr. Runne acknowledged. The agencyhad to move around 20,000 contacts from the existing managementsystem to the ProspX platform.

|

Additionally, Mr. Runne said the agency purchased a businesscard scanner. “People have hundreds, or even thousands of businesscards,” he noted, but without a system to help create a focal pointfor all of that business intelligence, the information could all belost, he added.

|The results of the system implementation, according to theagency, have “successfully transformed our sales culture,unleashing the critical knowledge and relationships of our salesprofessionals for the collective success of the entireorganization.”

|Mr. Runne said both senior and junior salespeople use the systemactively. He said the system has actually brought senior and juniorsalespeople closer together.

|When a junior salesperson is able to see that a seniorcounterpart has already contacted a potential customer, Mr. Runnesaid, the junior will not only ask about the contact but also seekadvice, treating the senior salespeople essentially as mentors.

|The senior salespeople, Mr. Runne said, are “really beginning totake to that mentorship.” They are not just giving contacts, heexplained, but are sharing experiences and lessons they'velearned.

|This, he observed, is a direct result of having a new techsystem in place.

|However, the system is one small part of a grander informationtechnology scheme for RCM&D, according to Mr. Runne. The agencyhas replaced every server and piece of hardware as part of a “veryaggressive IT strategy,” tied to its overall mission to keep theagency growing.

|An agency must stay “close to the curve,” Mr. Runne explained,to make sure it is up-to-date on new technology, and then pick andchoose which solutions work best for its specific needs.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.