In the current economic climate, insurers who look to programbusiness to generate additional premium volume will be conductingmore thorough due diligence examinations of potential programsbefore agreeing to take them on.

|Program administrators should therefore be prepared, whenmarketing an established program, to provide a potential newinsurance company partner with hard data, well-reasoned growthprojections and adequate time for the insurer to consider theopportunity.

|Underwriters looking for program business in this economy willbe seriously scrutinizing the quality of the program presentationmaterials to ensure the program will meet their acceptable criteriabefore they consider extending limited underwritingauthority.

To win insurers' confidence, program administrators mustdemonstrate that they are capable of underwriting the business.They will not get far delivering program rollover submissions thatare sketchy at best and unprofessional at worst.

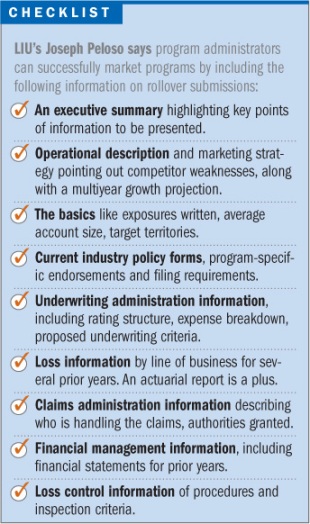

|Rather than unsupported promises that a program will be hugelysuccessful, underwriters typically want a submission that covers atleast nine areas of concern–in detail–for insurers. Be mindful toinclude only information not subject to any nondisclosureagreements.

|In the balance of this article, we outline one possible orderingof nine specific sections of a program administrator's proposal toaddress the key concerns of potential carrier partners.

|First, the presentation should contain an executive summary ofthe salient information in the next eight sections. This summarycan be a powerful marketing tool if the program agent has craftedthe submission with hard data and solidly reasoned projections.

|In addition, if the business is moving from an existing carrier,the summary should explain why the program administrator expectsthe program to prosper with a new insurance carrier and theattributes they are looking for in the new carrier.

|Following the executive summary, the program administratorshould provide a description of the program's operations, includinghow long it has been written, the r?sum?s of key managementpersonnel, and a description of the program's prior as well ascurrent proposed structure. This includes lines of business, limitsprovided and current carriers.

|In this second section, program administrators should present amarketing strategy that describes how desirable accounts will beidentified, examines the strengths and weaknesses of competitors'programs, and provides a well-founded, multiyear growth projectionthat takes into account the program's distribution system.

|Next, the program administrator should provide basic programinformation, including types of exposures written, the number ofinsureds, the average account size, the mix of states or regionswhere insureds are located, and the types of coverage insuredswant.

|Those coverages lead into the fourth section of thesubmission–detailed information about current industry policy formsthat are in use for the program. This information should includecopies of all program-specific endorsements and other specialfiling requirements.

|The mistake that program administrators sometimes make here isnot providing this information in a timely fashion. Sometimesspecialty policy forms need three-to-four months to be filed andapproved, but many program administrators begin marketing theirprograms only a few months before their scheduled renewal dates.The insurance carrier may not be able to participate in the programif it is not provided with adequate time to make the necessary formand rate filings to support the program.

|Another problem with timeliness arises with the next twosubmission sections: underwriting administration information andsummary program loss experience.

|Administration includes the rating structure, a breakdown ofexpense components and proposed underwriting criteria.

|Loss information requires currently valued loss information on aline of business basis for the previous three-to-five years. Anindependent actuarial report is a plus and will assist in theprogram evaluation.

|If, after examining the program experience, a potentialinsurance carrier determines it would need to adjust its filedrating structure, the insurer would need adequate time to obtainregulator approval. Again, marketing the program just a few monthsbefore the renewal date could eliminate consideration by manypotential insurance company markets.

|A program administrator should be realistic in its request forcommissions and work to align its interests with the carrier inorder to achieve underwriting profits.

|In the submission's last sections, the program administratorshould cover claims administration, financial management, losscontrol, and information on who is currently handling claims andwhat authorities and strategies are utilized. If the administratorcontrols a third-party administrator, at our firm, we require thatthe PA must show that the claims-handling operation is at arm'slength from the underwriting operation.

|The program administrator must submit financial documents,including its verified financial statements for the previous yearsas well as any risk-sharing agreements. At our company, we requirethe submission of two prior years of financial statements. Inaddition, the submission should include information on loss controlprocedures and inspection criteria.

|Overall, program administrators must bear in mind that theinsurer executives they approach with rollover submissions mighthave to convince their own management that the programs representgood opportunities. That will necessitate solid business plans.

|An insurer being asked to provide limited underwriting authoritywants to be assured that a program administrator considers itselfan underwriter that believes the business will be profitable,rather than someone whose top priority is simply placing business.A timely and thorough submission can help a program administratordemonstrate its expertise and commitment to a long-term, mutuallyprofitable relationship.

|Joseph Peloso is vice president-casualtyprograms for Liberty International Underwriters.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.