American International Group Inc. and Zurich Financial ServicesGroup announced a $1.9 billion deal last week for the sale of AIG'sauto unit–21st Century Insurance Group–to a Zurich subsidiary,Farmers Group Inc.

|Under the terms of the transaction, AIG said Farmers Group willpay $1.5 billion in cash and $400 million in face amount ofsubordinated, euro-denominated capital notes backed by ZurichInsurance Company–Zurich's principal operating unit. In addition,Farmers will also assume 21st Century's outstanding debt of $100million.

The acquisition is expected to close "no later than by the thirdquarter of 2009, pending customary regulatory approvals," Farmersnoted.

|Based in Wilmington, Del., 21st Century includes the former AIGDirect and Agency Auto business, employing some 6,000 people. AIGsaid the personal auto insurer operates in 49 states andWashington, D.C., with 2008 premiums of $3.6 billion–including $2.7billion in direct sales and $900 million through independentagents.

|The transaction, AIG said, excludes its AIG Private ClientGroup, which provides insurance to high-net-worth individuals.

|"We are very pleased to reach agreement on a $2 billiontransaction, especially in this market environment," said AIG'schairman and chief executive officer, Edward Liddy.

|He noted that the company–which also announced the sale lastweek of its wealth management arm, AIG Private Bank Ltd., to AabarInvestments PJSC of Abu Dhabi for $308 million–is "moving forwardwith discussions for several other transactions, and we continue toevaluate how best to assure the continued strength and success ofall of AIG's businesses."

|Zurich CEO James J. Schiro, in a statement explaining thepurchase, said that expansion of U.S. personal lines capabilitiesat Farmers has "always been one of our strategic priorities."Beefing up Farmers, he added, "reduces the overall volatility ofour portfolio of businesses, while continuing our focus onprofitable growth through customer, product and distributionexcellence."

|He said that despite the present economic climate, "financialdiscipline" can position Zurich to capitalize on marketopportunities–"provided they meet our strategic objectives andfinancial hurdle rates."

|The purchase of 21st Century, Zurich said, gives Farmersopportunities to achieve benefits of scale, as well as to leveragetalent and technical capabilities.

|"Both 21st Century and Farmers are strong companies, providingpolicyholders with exceptional levels of service and personalizedcoverage," said Anthony J. DeSantis, 21st Century's president andCEO. "This is an excellent fit, and we look forward to a smoothintegration that will be seamless to our customers."

|F. Robert Woudstra, CEO of Farmers Group Inc., said the dealpositions Farmers as "the fastest growing personal andsmall-business insurer in America," giving his company an expandedagency force and "one of the most successful direct distributionplatforms within one of the fastest growing distribution channelsin the U.S." Farmers said its direct sales distribution channelgrew from 7.7 percent to 18 percent of the total U.S. autoinsurance market from 1997 to 2006.

|IN OTHER NEWS

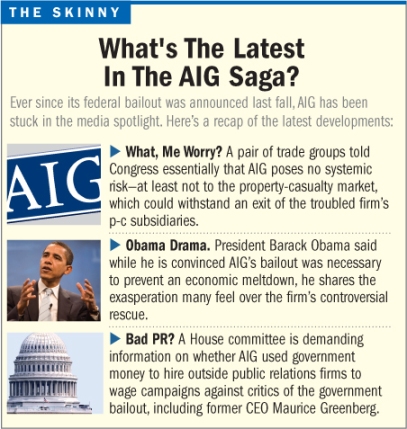

|Meanwhile, a pair of insurer trade groups urged Congress todismiss any concerns that an AIG bankruptcy might pose a "systemicrisk" to the property-casualty industry, the NationalUnderwriter has learned.

|"There is no basis to believe that consumers would suffer anysignificant or long-term adverse consequences in the event any ofAIG's p-c operations exited the marketplace," according to a letterobtained by NU and an accompanying PowerPoint presentationproduced by the American Insurance Association and the PropertyCasualty Insurers Association of America.

|The presentation to the leadership of congressional financialservices committees came in response to a document provided to theTreasury Department and Federal Reserve Board by AIG to justify aninfusion of additional funds to the company as it reported a $61.7billion loss on March 2.

|The documents were given to the majority and minority staffs ofthe Senate Banking Committee and House Financial Services Committeeon April 8 by officials of AIA and PCI.

|Specifically, the letter accompanying the presentation said that"if AIG's p-c companies ceased operations, there is availablecapacity, existing competition and institutional readiness withinthe remaining members in the industry to meet the needs of theinsuring public."

|Moreover, the letter added, "our message is straightforward–thetraditional P&C industry does not today pose a systemic risklike other financial segments. We are competitive, well-capitalizedand able to respond to policyholder needs, as we have demonstratedin the past, when a competitor of any size leaves the market."

|The Treasury and Fed used the document to revise their policy onhow to recover funds the government has advanced to AIG–from one ofrepaying the government through the sale of its life insurancebusinesses, to one of giving the government a stake in some of itsoperating businesses as collateral for the government loans.

|AIG, in its justification for additional aid, argued that "AIGcontinues to pose a systemic risk" and requires immediateadditional federal assistance, warning that "otherwise [AIG's]failure would cause multiple and potentially catastrophicunforeseen consequences."

|The document noted up front that AIG's systemic risk derivesprimarily from its Financial Products subsidiary–which tradedcredit default swaps on subprime mortgage-backed securities–addingthat with respect to insurance, "the systemic risk is principallycentered in the 'life insurance' business."

|The property-casualty groups said in their April 8 presentationthat they "recognize there may be systemic issues with respect toAIG's non-insurance operations, and we do not speak on behalf ofthe life insurance industry."

|In related news, a House committee is demanding information onwhether AIG used government money to hire outside public relationsfirms to wage campaigns against critics of the governmentbailout.

|Rep. Edolphus Towns, D-N.Y., chair of the House Committee onOversight and Government Reform, sent a letter to AIG last weekdemanding detailed data on whether public funds were used toconduct the campaign.

|The letter was sent after the committee received informationthat outside PR firms were being used by AIG to discount thecriticism of Maurice "Hank" Greenberg, the company's formerchairman and chief executive, who testified at a hearing earlierthis month by Rep. Towns' committee concerning facts surroundingAIG's troubled financial situation.

|Rep. Towns' letter, addressed to Mr. Liddy, demanded copies ofany contracts between AIG and two public relationsfirms–Burston-Marsteller and Hill & Knowlton–and specificallyasked whether a paper titled "The Greenberg Legacy" was "authoredand circulated by, or at the behest of, AIG."

|The letter said Rep. Towns "would be extremely disappointed tolearn that any of the billions of taxpayer dollars invested tosupport AIG may have been diverted to finance a public relationscampaign against critics of the AIG bailout. In my view, theseallegations warrant further inquiry to ensure that federal fundsare not being misused."

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.