Other methods to defer same-year taxes include "opportunity zone" investing and installment-sale transactions. Opportunity zone investments involve engaging in business or real estate developments in geographic areas that qualify for specific federal government tax incentives. Profits from sales reinvested in an opportunity zone are not subject to capital gains taxes until the 2026 tax year. Credit: devrim_pinar/Adobe Stock

Other methods to defer same-year taxes include "opportunity zone" investing and installment-sale transactions. Opportunity zone investments involve engaging in business or real estate developments in geographic areas that qualify for specific federal government tax incentives. Profits from sales reinvested in an opportunity zone are not subject to capital gains taxes until the 2026 tax year. Credit: devrim_pinar/Adobe Stock

Over your career, you have diligently built a business, a culture, and a community. Now, with retirement on the horizon, a business sale can secure your legacy and ensure the well-being of your employees and esteemed clients.

While you focus on maximizing the value of your business and finding the right buyer, don't overlook the impact of a business sale on your personal finances.

Recommended For You

Pay less in taxes

Even a small percentage of tax savings on a multimillion-dollar deal can translate into significant dollars. There are several strategies for tax optimization that can potentially increase the proceeds from your business sale, including tax deferral on received private-company stock, post-sale tax savings, and advanced planning.

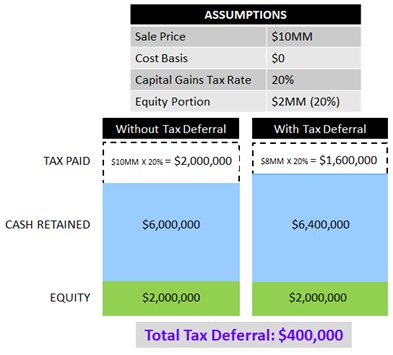

Tax deferral on received stock: In many business sales to private equity-backed firms, sellers receive up to 20% of the deal value in the form of private company stock. While capital gains tax is typically paid on the entire gain from the sale, careful deal structuring can enable tax deferral on the associated tax liability related to the received equity. This distinction is substantial, as demonstrated in the following example:

Credit: Hurley Capital, LLC

Credit: Hurley Capital, LLC Consider a scenario where the seller receives $10 million for the business with no cost basis. Twenty percent of the $10 million is paid in the form of equity in the acquiring firm. Without a tax deferral on the $2 million of received equity, the seller would incur $2 million in capital gains tax. However, with a tax deferral, the seller would save $400,000. Moreover, if the seller resides in a state with income tax, the deferral would be even more.

By keeping the private-equity shares illiquid for an extended period, the seller benefits in two key ways: (1) retaining the cash associated with the tax deferral, and (2) potentially paying tax on a lower gain if the shares are eventually sold at a diminished value, without any tax-loss carryforward.

Post-sale tax savings: The income generated from a business sale often results in the owner's highest-income year for many years to come. Owners can potentially lower the overall tax rate on the sale by shifting a portion of the income to future years.

For sellers who typically make annual charitable contributions, the establishment of a donor-advised fund (DAF) sale-year taxes can provide meaningful tax mitigation. A DAF consolidates several years of planned charitable donations into a single larger taxable deduction in the year of the business sale. This approach not only simplifies the process of donating but also provides an upfront tax benefit.

Other methods to defer same-year taxes include "opportunity zone" investing and installment-sale transactions. Opportunity zone investments involve engaging in business or real estate developments in geographic areas that qualify for specific federal government tax incentives. Profits from sales reinvested in an opportunity zone are not subject to capital gains taxes until the 2026 tax year. Furthermore, if the opportunity zone investment is held for over 10 years, no capital gains tax is incurred upon the sale. Installment sales involve structuring deals in a way that pays sellers over multiple years, thus enabling the spreading out of capital gains. Some sellers may prefer to avoid installment sales due to the delayed receipt of sales proceeds and reinvestment opportunities.

Advanced planning: For owners who do not plan to sell for at least a year, there are two interrelated advanced planning strategies that may be beneficial. One strategy focuses on mitigating taxes in high-tax states, while the other serves estate planning purposes.

In both cases, the owner sells the business to an irrevocable trust (or trusts) domiciled in a no-income-tax state at a discounted appraised valuation. If the trust is structured as a grantor trust, where the owner is responsible for taxes on trust income, no tax will be owed on this transaction. Subsequently, when the business is sold to an outside buyer, taxes are assessed based on the location of the trust. State taxes are only incurred when the trust distributes income.

This structure also proves advantageous for estate planning, particularly for owners with substantial estates, irrespective of state income tax considerations. The trust(s) capture the entire value difference between the discounted sale from the owner and the subsequent sale to an outside buyer. Additionally, the owner assumes responsibility for paying all capital gains taxes. For individuals with large estates, this technique can be exceptionally valuable. We strongly recommend consulting a tax lawyer to obtain tailored advice based on your specific circumstances.

Post-deal finances

Following the sale of your business, you will trade the flexibility of income and expenses for a fixed, lower salary, possibly supplemented by an earn-out arrangement. Expenses such as car payments, insurance, and entertainment, previously covered by the business, will become your personal responsibility. The new fixed salary may not cover increased living expenses, necessitating the use of savings. This transition can be unsettling for many business owners accustomed to continuously adding to their savings.

To address this situation, it is vital to create a comprehensive plan that encompasses your salaried working years through retirement. Consider the following questions:

- What is your new salary?

- Is your earn-out achievable? If so, how much can you expect to receive and when?

- Will you retire once your employment contract expires?

- Do you own the office space occupied by your business? If you rent it to the new owner, how much rental income will you receive and for how long?

- What other sources of income can you expect, such as Social Security and IRA distributions?

- What are your current living expenses?

- Are there any significant one-time expenses to consider, such as children's weddings, education costs, or planned relocation?

Answering these questions will aid in projecting and safeguarding your future finances. Key takeaways include:

The answers to the questions above form the foundation of a robust financial plan, which can be adjusted as circumstances change.

The results may yield surprising outcomes, potentially making previously unattainable goals, such as owning a vacation home, viable.

Armed with detailed financial information, you can strategically deploy your business-sale proceeds in the most advantageous manner.

Financial priorities with deal proceeds

A business owner's balance sheet is typically dominated by his/her business holdings. However, a sales transaction, combined with the dissolution of the company's retirement plan, brings forth an unprecedented level of liquidity and consequential decisions.

Consider the following aspects:

- Will you require annual withdrawals from the sales proceeds to support your lifestyle?

- Can you sustain your living expenses solely from portfolio growth, or will you need to draw down on your savings?

- What level of investment return do you need to achieve your financial objectives?

- Do you have specific intentions for allocating funds to charitable causes or beneficiaries?

Armed with this information, you can determine your spending needs and income requirements from your portfolio. Then, you can specify investment allocations across stocks, bonds, real estate, and even new business ventures. The key lies in determining the necessary return on your investments and taking appropriate steps to achieve that goal.

Remember, a large investment portfolio will create new tax risks and opportunities. As an example, while a bond portfolio creates recurring taxable income, treasury bonds are exempt from state income tax, and dividend income is taxed at a preferential rate. New investment opportunities may also present avenues for further tax optimization, such as prioritizing real estate income, as well as strategic timing of Social Security withdrawals or Roth conversions of your IRA.

A business sale can be a liberating moment and a significant accomplishment for many owners. Given the substantial financial implications involved, ensuring precise attention to detail can profoundly impact the after-tax benefits. With foresight and access to specific solutions, even seasoned business owners can confidently execute what may be the most consequential transaction of their careers.

Charles Goldblum, CFA, CFP, is founder and portfolio manager at Hurley Capital, LLC.

Opinions expressed here are the author's own.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.