As northern Californians begin to assess the damage caused by the week-long fires that ravaged the area, a new Moody's report estimates insured losses for P&C insurers will be among the costliest ever recorded.

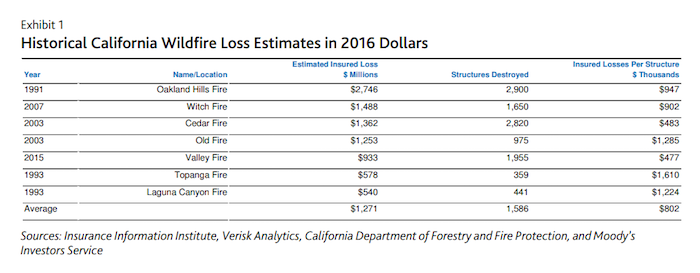

Moody's estimates losses will reach $4.6 billion or higher, based on data from the California Department of Forestry and Fire Protection (CAL FIRE). This number comes from data shown in Exhibit 1, where CAL FIRE estimates 5,700 structures have been destroyed with an average value of $802,000 per structure.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.