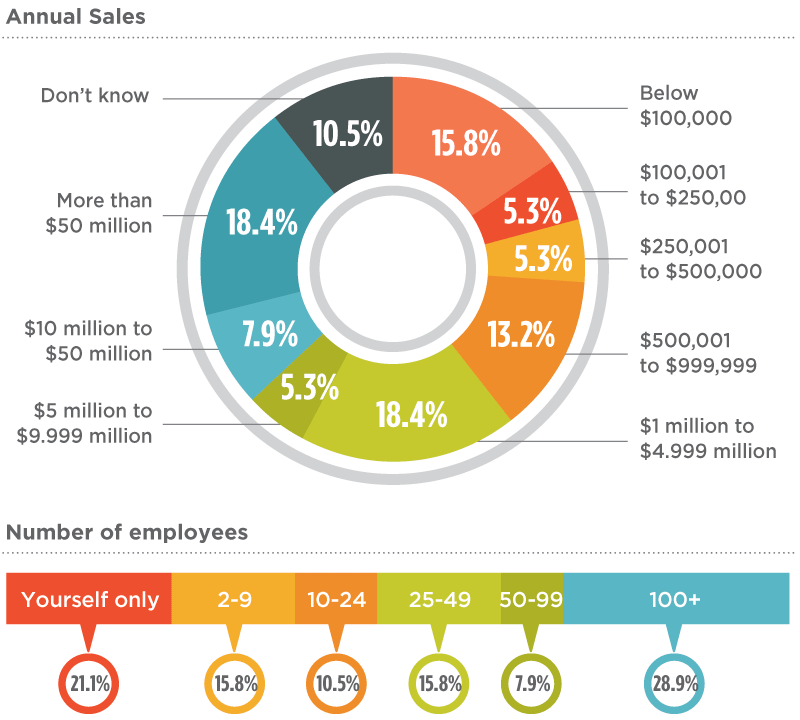

No one disputes the fact that the business of insurance has changed dramatically in the last five years. Technology, new perils like the Ebola virus and an increase in fraud make the insurance profession even more challenging today. Claims magazine asked our subscribers about their job satisfaction, the number of hours they work in an average week, the benefits they receive and a host of other questions. A total of 368 people responded from firms with average sales ranging from under $100,000 to over $50 million. The firms employed anywhere from one person to over 100 people. Here's a quick breakdown of the firms represented:

Of the respondents, 75% were male and 25% were female, and they responded to some or all of the questions. Here's what we learned.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.