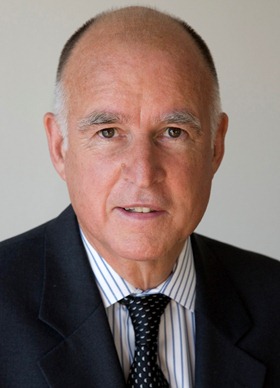

California Governor Jerry Brown has formally signed a bill limiting professional athletes from receiving workers' compensation benefits in California if they live and play predominantly outside the state.

California Governor Jerry Brown has formally signed a bill limiting professional athletes from receiving workers' compensation benefits in California if they live and play predominantly outside the state.

The bill, AB1309, which received bipartisan support as well as that of sports organizations such as the National Football League, was proposed in 2012 by Assemblyman Henry T. Perea (D-Fresno) to prevent out-of-state athletes from “unfairly targeting” California's WC system.

“This new law sets reasonable standards to close an expensive loophole unique to California and to professional sports,” says Dennis Kuhl, chairman of the Los Angeles Angels of Anaheim. “This change isn't just good for California baseball teams—it's good for all California businesses and their workers and ensures that our workers' compensation system is there for in-state players.”

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.