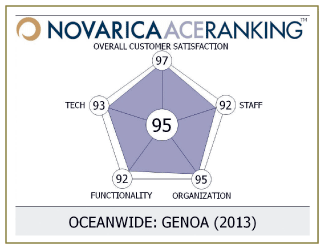

Company: Oceanwide

Company: Oceanwide

Products: Genoa and Bridge

Representative: Rob Copenhaver, Vice President of Sales, North America

To what do you attribute the positive ratings from your customers?

In over 16 years Oceanwide has never lost a customer. We attribute this to our customer-centric product innovations, responsiveness to custom requirements, and customer care and support. We engage our customers on a regular basis to understand their business needs, workflows and challenges and leverage product customizations to benefit all of our clients. Our customer support is available 24/7.

How do you communicate with your insurance carrier customers to meet their needs?

How do you communicate with your insurance carrier customers to meet their needs?

We solicit feedback from our customers through our dedicated account managers who are in regular contact with our customers, and prioritize many new product features and improvements based on customer and market demand. These improvements are typically implemented on a platform-wide basis, not as product enhancements, ensuring all our customers benefit from new product innovations. Oceanwide also hosts several client events, including an annual user conference.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.