While the total of terror attacks has declined on a global basis, the number of incidents remains at historic highs and insurers need to continue monitoring situations to better understand risk, says Guy Carpenter.

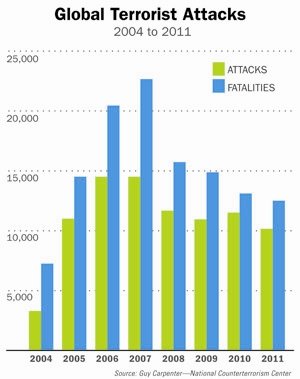

In its continuing series GC Capital Ideas, the reinsurance broker says that based on figures released by the National Counterterrorism Center, there has been a general decline in the number of terror attacks over the past five years from their peak of 14,400 in 2006. According to the NCTC, there were over 10,000 terrorist attacks in 2011 resulting in over 12,500 deaths.

However, when viewed over an eight year period, 2004, when the NCTC began collecting data, to 2011, the levels today remain historically high.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.