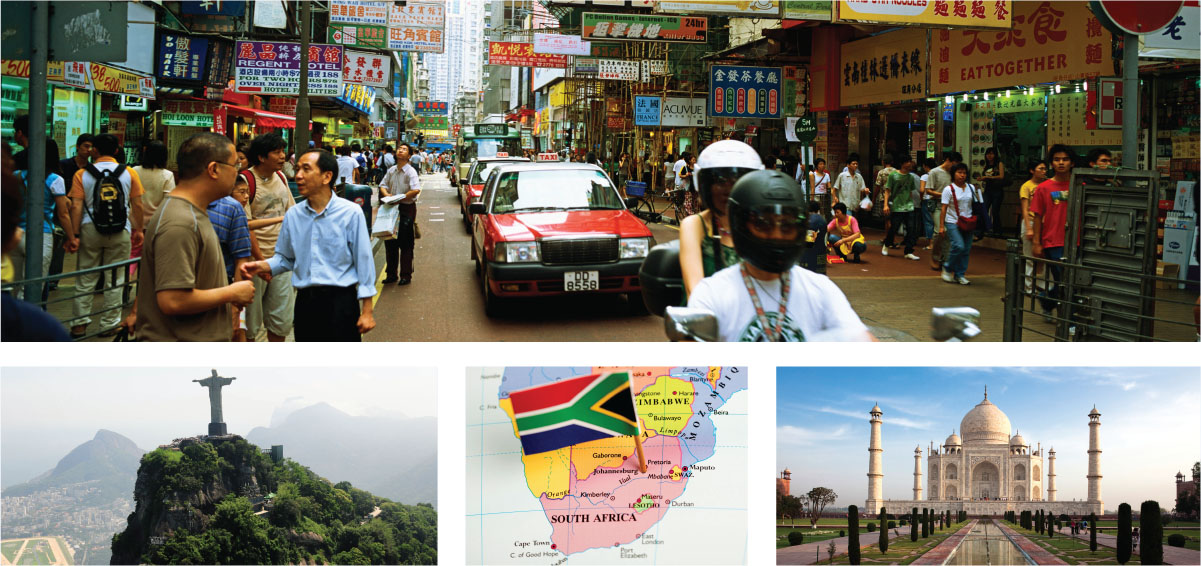

Burgeoning economies in emerging markets overseas provide enticing opportunities for insurance companies, and some major carriers are aggressively seeking to bolster their global market share.

Burgeoning economies in emerging markets overseas provide enticing opportunities for insurance companies, and some major carriers are aggressively seeking to bolster their global market share.

Despite the inherent challenges in doing business in foreign territories—including the chance of adverse political developments; competition from local insurers; the need for establishing distribution networks; and mostly low underwriting margins—the potential upside to international expansion is too great to be ignored.

Asia and Latin America have contributed the most to emerging-market premium growth in the past decade, driven both by their healthy economic environments and improvements in insurance regulations.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.