Contractors confront some perplexing insurance coverage problems in their daily business activities. Let's explore a few common scenarios briefly and discuss if and when coverage applies to structures.

Contractors confront some perplexing insurance coverage problems in their daily business activities. Let's explore a few common scenarios briefly and discuss if and when coverage applies to structures.

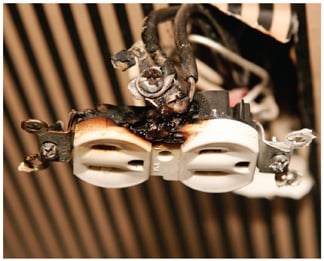

Product and Work ExclusionsWhen a contractor negotiates with another party to perform some work, the contractor may extend an express warranty that its construction materials and services will be provided in a reasonably workmanlike fashion. Even if the contractor does not express such a warranty, the mere act of holding himself or herself out as being able to do the work creates an implied warranty that the materials will be fit for their particular purpose(s), and that work will be performed in a competent, skillful manner.

Insurance underwriters often refer to the consequences that can result from such warranties as business risks, or the risk that the contractor will need to repair or replace defective products or redo faulty work. While insurers are generally willing to insure the risk that the faulty work or products of the insured will cause bodily injury or property damage to another party, they are simply not willing to insure the business risk; that is, insurers do not wish to become the guarantors of the fitness, quality, or reliability of the insured's work or products.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.