It is no surprise to find that, in most lines of business, claims managers are assuming heavier caseloads. With 250 or more open files to manage, mastering the multitude of timelines involved with litigated claims drains precious time.

It is no surprise to find that, in most lines of business, claims managers are assuming heavier caseloads. With 250 or more open files to manage, mastering the multitude of timelines involved with litigated claims drains precious time.

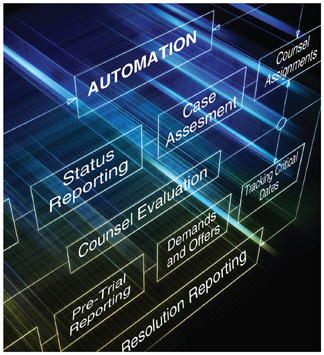

The claims manager's law firm and staff counsel partners provide critical support and expertise in shouldering the added burden. Even with this assistance, the claims organization is ultimately accountable for managing critical dates and growing legal expenses in an environment where carriers demand ever-increasing transparency and greater control over operational decisions. Often, technology is expected to offer answers. Of course, technology alone can only do so much. To answer all of the questions involved, one must examine the impact of applying technology to the litigation management process and what considerations must be met in order to reach a successful application.

The task management, calendaring, and information procurement involved with litigated claims necessitates the precise application of technology. Reaching key milestones, applying expertise at each point of decision, falls to the claims manager, his or her staff, and/or panel counsel partners. Project management is a necessary evil when dealing with an increasing caseload, but often one that is not a natural skill for claims managers or counsel.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.