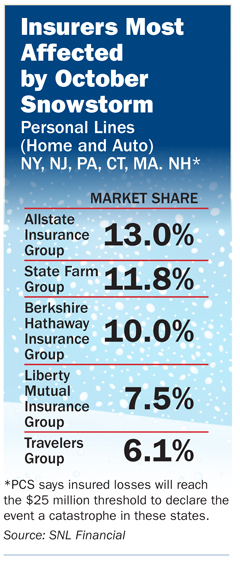

The freak October snowstorm that dumped more than 2 feet of snow in some locations is expected to be a major capital or credit event for the property and casualty insurance industry, says credit rating service Moody’s.

The freak October snowstorm that dumped more than 2 feet of snow in some locations is expected to be a major capital or credit event for the property and casualty insurance industry, says credit rating service Moody’s.

The Oct. 29 storm knocked out power to close to 2 million homes and businesses at its height over a six-state region. The storm is expected to result in economic damage in excess of $1 billion. Moody’s says the storm is credit negative for P&C insurers in the U.S. and is expected to adversely affect earnings “during a year of unprecedented catastrophe losses.”

Tree damage is expected to be substantial as the storm piled snow on leaf-covered trees. The weight of the snow snapped many limbs and huge branches, producing damage to homes and cars from downed trees and limbs. Debris removal and auto accidents add to the tally of damages. There may also be “time-element” claims, such as reimbursement for additional living expenses (ALE)—such as hotel stays—for those displaced from their homes during the power outage, Moody’s says.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.