Recommended Stories

Pet insurance gross written premiums grew more than 20% in 2023

The sector’s gross written premiums have been growing by 20%-30% annually since 2020.

Navigating the complexities of representations and warranties insurance

RWI helps facilitate smoother transactions by transferring transaction-related risks to insurance carriers.

Survey blames class action spike in-part on surge in 'employee activism'

Labor and employment class actions accounted for 43.4% of legal departments' class action matters in 2023 – an increase of nearly 10 percentage points from a year earlier.

Resource Center

Guide

Sponsored by gryphon.ai

The Ultimate Guide to SMS/Text Messaging Compliance

This guide empowers insurance carriers and risk managers to navigate complex regulations, safeguarding their brands from costly SMS and text messaging penalties.

White Paper

Sponsored by Origami Risk

Build or Buy? Considering the Critical Decisions in P&C Core Insurance Cloud Digitization Projects

Navigating the complexities of P&C core insurance digitization is no easy task. Explore the critical decisions between building or buying and how to achieve operational excellence in this white paper.

White Paper

Sponsored by Melissa

Clean Your Data to Win the Customer Retention War

As more customers “unbundle” their insurance products and spread their business among many carriers, agents must look for creative strategies to retain and grow business. Download this white paper to learn top strategies to ensure success in 2024.

PropertyCasualty360

Don’t miss crucial news and insights you need to make informed decisions for your P&C insurance business. Join PropertyCasualty360.com now!

- Unlimited access to PropertyCasualty360.com - your roadmap to thriving in a disrupted environment

- Access to other award-winning ALM websites including BenefitsPRO.com, ThinkAdvisor.com and Law.com

- Exclusive discounts on PropertyCasualty360, National Underwriter, Claims and ALM events

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

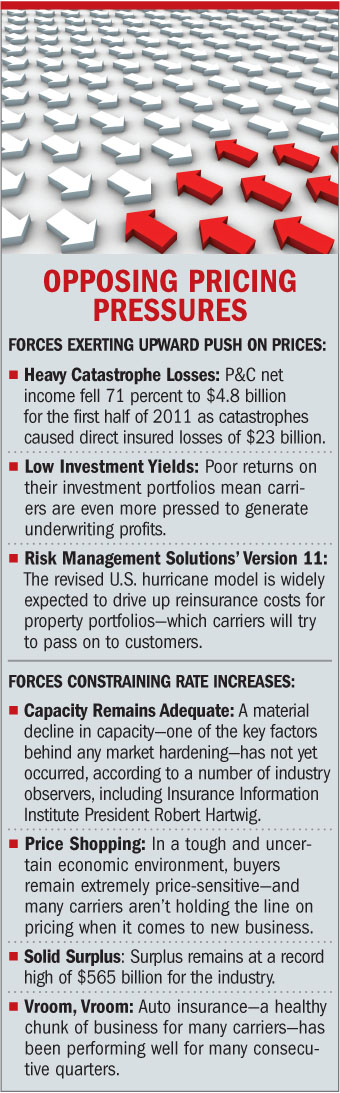

After a year of near-record catastrophe losses, increasing combined ratios and highly disappointing investment yields, the natural expectation is that insurers looking to stabilize their books have but one choice: to raise prices.

After a year of near-record catastrophe losses, increasing combined ratios and highly disappointing investment yields, the natural expectation is that insurers looking to stabilize their books have but one choice: to raise prices.