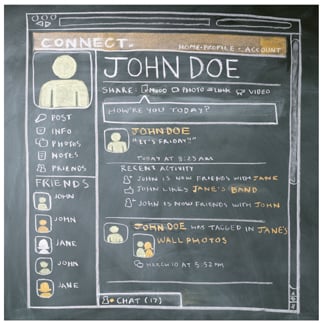

If 2011 has a catchphrase, then it may be, "There's an app for that!" For many insurance professionals fighting fraud and noticeably exaggerated claims, there is a new application (app) of sorts in the form of social media. Adjusters can use social media as a tool to combat claimants' allegation of damages. For example, if a bodily injury claimant moans about severe disability and alteration of lifestyle because of an insured event, then social media can provide evidence to either verify or disprove those allegations. It is not unheard of for claimants asserting serious injuries to post Facebook pictures and status updates depicting various physical activities that undermine the credibility of disability allegations. If a claimant or plaintiff is foolish enough to leave his or her social media privacy settings such that they allow virtually anyone to view personal posts, then this becomes a legitimate area ripe for claims investigation and legal discovery.

If 2011 has a catchphrase, then it may be, "There's an app for that!" For many insurance professionals fighting fraud and noticeably exaggerated claims, there is a new application (app) of sorts in the form of social media. Adjusters can use social media as a tool to combat claimants' allegation of damages. For example, if a bodily injury claimant moans about severe disability and alteration of lifestyle because of an insured event, then social media can provide evidence to either verify or disprove those allegations. It is not unheard of for claimants asserting serious injuries to post Facebook pictures and status updates depicting various physical activities that undermine the credibility of disability allegations. If a claimant or plaintiff is foolish enough to leave his or her social media privacy settings such that they allow virtually anyone to view personal posts, then this becomes a legitimate area ripe for claims investigation and legal discovery.

Social media's popularity is a mixed blessing for insurance companies and claims organizations. Many managers and executives fret about the time wasted by claims adjusters trolling through Facebook, Twitter, YouTube, or tweaking their online resumes on LinkedIn.

New Causes of Action

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.