We at FC&S viewed the news footage with horror after a deadly tornado swept through Joplin, Mo. on May 22. The devastation has already caused immediate deaths, injuries, and property damage. As the cleanup continues, new problems are arising.

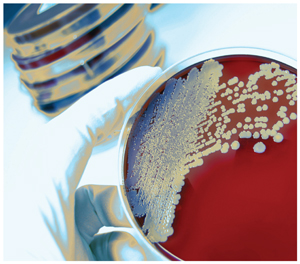

Recently, news outlets have reported that a number of the people who were injured as a result of the tornado have been infected with a deadly fungal infection, mucormycosis, which occurs when a spore enters the body after a cut or other injury. According to the Centers for Disease Control (CDC), similar infections were found in some victims of the earthquake and the resultant tsunami in Japan. Although characterized as extremely unusual, the descriptions of events in the earlier cases are very similar to those identified in Mo. Emergency centers were able to identify victims' infections as mucormycosis after their admittance and treatment for tissue injuries.

Although we may not be well-versed in the science of deadly fungal infections, the insurance industry has grappled with issues arising from mold for many years. Policy drafters have taken steps to control the amount of coverage available, but as new developments occur, there will surely be a renewed need to understand whether and how much insurance coverage is available to property owners who find mold growing in their buildings. Far more common than deadly infections will be the occurrence of mold in properties that could not immediately be made watertight after portions were blown away in the storm.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.