More than a year has passed since the Deepwater Horizon incident, though the battles are far from over. Among them are third-party claims seeking to recover lost business revenue. From hotel operators and sport and commercial fisherman to cruise ship operators, numerous business owners are seeking compensation for losses they incurred from the April 2010 event.

sport and commercial fisherman to cruise ship operators, numerous business owners are seeking compensation for losses they incurred from the April 2010 event.

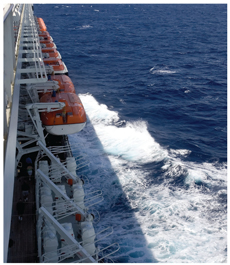

No More Smooth Sailing

On April 20, 2011, Carnival Corporation ("Carnival") filed suit against BP PLC, Transocean Ltd., and other drilling companies involved in operations on Deepwater Horizon. The cruise line seeks compensation for its economic losses and damages as a result of the April 20, 2010 explosion, fire, and oil spill in the Gulf of Mexico. Barely meeting the deadline to file suit against the rig owners in the multidistrict litigation in La., Carnival alleges claims for negligence, strict liability for manufacturing defect, fraudulent concealment, violation of the Oil Pollution Act (OPA) of 1990, and strict liability pursuant to the Florida Pollutant Discharge Prevention and Control Act.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.