NOT FOR REPRINT

Page Printed from: propertycasualty360.com/national-underwriter-property-casualty/issue-gallery/

Issue Gallery

NU Property & Casualty

Delivering All the Must-Have Information Insurance Professionals Need. NU Property & Casualty, the industry’s most reputable and trusted brand, delivers field-tested and sales-driven strategies along with a comprehensive blend of feature analysis and peer-to-peer content to give agents, brokers and other key insurance professionals the crucial information they need to be successful.

{

"magazine": [

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2023/11/NUP-Cover_Nov-Dec-2023.png",

"title": "November/December 2023",

"slug": "novemberdecember-2023",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC1123/index.html?oly_enc_id=5790G1372767D5J"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2023/10/NU-Property-Casualty-Oct23-Cover.jpg",

"title": "October 2023",

"slug": "october-2023-1",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC1023/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2023/09/NU0923_Cover_Vol.-127_Issue-6.jpg",

"title": "September 2023",

"slug": "september-2023-1",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0923/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2023/08/Cover_0823.jpg",

"title": "August 2023",

"slug": "august-2023",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0823/index.html#p=Covertip1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2023/06/NU06_0723_Cover.jpg",

"title": "June/July 2023",

"slug": "junejuly-2023",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0623/index.html?oly_enc_id=5790G1372767D5J#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2023/04/PNC_Cover_0423.jpg",

"title": "April/May 2023",

"slug": "aprilmay-2023-1",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0423/mobile/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2023/03/NU0323_Cover.jpg",

"title": "March 2023",

"slug": "march-2023",

"summary": "",

"digitalEditionUrl": "https://alm.omeclk.com/portal/wts/ug%5EcmSegwqehvqj%7C7a%7CsFgva0khqj%7Coh9n1ta"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2023/02/NU01_02_23_Cover.jpg",

"title": "January/February 2023",

"slug": "januaryfebruary-2023-2",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0123/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2022/11/NU11_1222_Cover.jpg",

"title": "November/December 2022",

"slug": "november-december-2022",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC1122/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2022/10/Cover_1022.jpg",

"title": "October 2022",

"slug": "october-2022-1",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC1022/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2022/09/NU0922_Cover.jpg",

"title": "September 2022",

"slug": "september-2022-1",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0922/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2022/08/August-2022-NUP-Cover-Art.jpg",

"title": "August 2022",

"slug": "august-2022",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0822/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2022/06/NU0622_Cover.jpg",

"title": "June/July 2022",

"slug": "junejuly-2022",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0622/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/292/2022/03/NUP0422.jpg",

"title": "April/May 2022",

"slug": "aprilmay-2022-1",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0422/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/2022/04/PNC_0322.jpg",

"title": "March 2022",

"slug": "march-2022",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0322/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2022/02/NUP_Cover_JanFeb22.jpg",

"title": "January/February 2022",

"slug": "januaryfebruary-2022-1",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0122/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2021/12/NUPC_December-2021-Cover.jpg",

"title": "December 2021",

"slug": "december-2021",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC1221/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2021/11/NUPC-Cover_November-2021_Sized-Down.jpg",

"title": "November 2021",

"slug": "november-2021",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC1121/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2021/10/NUPC-Cover_October-2021_Vol.-125_No.-8.jpg",

"title": "October 2021",

"slug": "october-2021",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC1021/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2021/09/NUPC-Cover_Sept-2021.jpg",

"title": "September 2021",

"slug": "september-2021",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0921/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2021/08/PNC-Cover_July-August-2021.jpg",

"title": "July/August 2021",

"slug": "julyaugust-2021-1",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0721/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2021/06/PNC_0621_Cover.jpg",

"title": "June 2021",

"slug": "june-2021",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0621/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2021/05/May-2021-NUPC-Cover-for-PC360.jpg",

"title": "May 2021",

"slug": "may-2021-1",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0521/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2021/04/April-2021-NUPC-Cover-2.jpg",

"title": "April 2021",

"slug": "april-2021",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0421/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2021/03/March-2021-Cover.jpg",

"title": "March 2021",

"slug": "march-2021",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0321/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2021/02/NUPC-Cover_Jan-Feb-2021.jpg",

"title": "January-February 2021",

"slug": "january-february-2021",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0121/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2020/12/Cover_December-2020_NUPC.jpg",

"title": "December 2020",

"slug": "december-2020",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC1220/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2020/11/NUPC-November-2020-Cover.jpg",

"title": "November 2020",

"slug": "november-2020",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC1120/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2020/10/Oct-2020-NU-Cover.jpg",

"title": "October 2020",

"slug": "october-2020",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC1020/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2020/09/NUPC-Cover_Sept-2020.jpg",

"title": "September 2020",

"slug": "september-2020",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0920/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2020/08/0820_NUPC_Cover.jpg",

"title": "August 2020",

"slug": "august-2020",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0820/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2020/07/July-2020-NUPC-Cover.jpg",

"title": "July 2020",

"slug": "july-2020",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0720/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2020/06/June-NU-Cover-for-PC360.jpg",

"title": "June 2020",

"slug": "june-2020",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0620/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2020/05/NUPC_May-2020_Cover.jpg",

"title": "May 2020",

"slug": "may-2020",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0520/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2020/04/NU0420_Cover.jpg",

"title": "April 2020",

"slug": "april-2020",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0420/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2020/02/NU0320_Cover.jpg",

"title": "March 2020",

"slug": "march-2020",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0320/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2020/02/Feb-2020-NUPC-Cover.jpg",

"title": "February 2020",

"slug": "february-2020",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0220/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2020/01/NUPC_Jan2020_Cover.jpg",

"title": "January 2020",

"slug": "january-2020",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0120/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2019/12/NU1219_Cover.jpg",

"title": "December 2019",

"slug": "december-2019",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC1219/index.html#p=C1"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2019/11/Nov-19-NUPC-Cover.jpg",

"title": "November 2019",

"slug": "november-2019",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC1119/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2019/10/October-2019-Cover_NUPC.jpg",

"title": "October 2019",

"slug": "october-2019",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC1019/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2019/09/NUPC_Sept-2019-Cover.jpg",

"title": "September 2019",

"slug": "september-2019",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0919/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2019/08/August-2019-NUPC.jpg",

"title": "August 2019",

"slug": "august-2019",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0819/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2019/07/NUPC-Cover-0719.jpg",

"title": "July 2019",

"slug": "july-2019",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0719/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2019/06/NUPC-Cover-June-2019.jpg",

"title": "June 2019",

"slug": "june-2019",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0619/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2019/05/0519-NUPC-Cover.jpg",

"title": "May 2019",

"slug": "may-2019",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0519/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2019/04/April-2019-Cover-NUPC-2.jpg",

"title": "April 2019",

"slug": "april-2019",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0419/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2019/03/March-2019-National-Underwriter-Cover.jpg",

"title": "March 2019",

"slug": "march-2019",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0319/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2019/01/0219NUPC-Cover.jpg",

"title": "February 2019",

"slug": "february-2019",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0219/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2019/01/0119_Cover.jpg",

"title": "January 2019",

"slug": "january-2019",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC0119/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2018/12/1218-Cover.jpg",

"title": "December 2018",

"slug": "december-2018-1",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC1218/index.html"

},

{

"imageUrl": "//www.almcms.com/contrib/content/uploads/sites/414/2018/11/1118-NUPC-Cover.jpg",

"title": "November 2018",

"slug": "november-2018",

"summary": "",

"digitalEditionUrl": "https://www.propertycasualty360.com/media/digitaleditions/pnc/PNC1118/index.html"

}

]

}

Trending Stories

- 1The Future of Embedded Insurance Demographic

- 2Reinventing GL and BOP Programs: How Proper Risk Classification Can Boost Your Bottom Line

- 3State Farm's Ting fire monitor detected and mitigated over 500 fires in 2022

- 4These airports are some of the scariest on the globe

- 5Most cyber insurance policyholders have a massive coverage gap

Resources

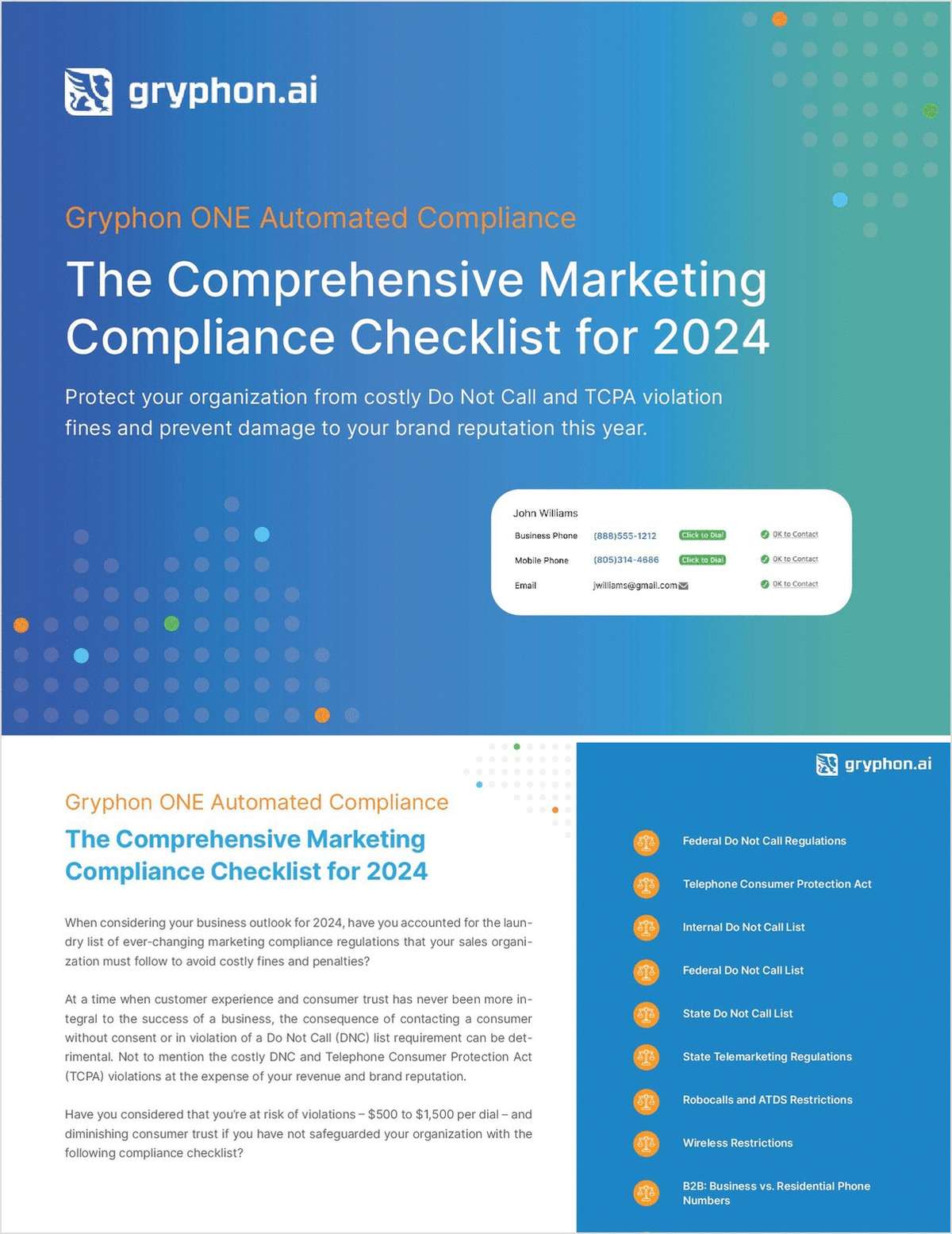

gryphon.ai

From gryphon.ai

Is your organization protected against costly Do Not Call (DNC) and Telephone Consumer Protection Act (TCPA) violations and fines? This comprehensive checklist explores key compliance areas, offering insights to mitigate risks and protect your brand reputation in 2024.

Download Resource

Origami Risk

From Origami Risk

Explore common pitfalls in core insurance transformations and how to avoid them. Discover comprehensive strategies and best practices to successfully plan and execute a cloud implementation in this comprehensive white paper.

Download Resource

gryphon.ai

From gryphon.ai

This guide empowers insurance carriers and risk managers to navigate complex regulations, safeguarding their brands from costly SMS and text messaging penalties.

Download Resource

Origami Risk

From Origami Risk

Navigating the complexities of P&C core insurance digitization is no easy task. Explore the critical decisions between building or buying and how to achieve operational excellence in this white paper.

Download Resource

Melissa

From Melissa

As more customers “unbundle” their insurance products and spread their business among many carriers, agents must look for creative strategies to retain and grow business. Download this white paper to learn top strategies to ensure success in 2024.

Download Resource

gryphon.ai

From gryphon.ai

Empower your organization to excel in marketing outreach without compromising compliance. This guide offers a roadmap to implement a best-in-class contact compliance strategy so that your organization can continue successful marketing campaigns, ethically and legally.

Download Resource

gryphon.ai

From gryphon.ai

Is your organization protected against costly Do Not Call (DNC) and Telephone Consumer Protection Act (TCPA) violations and fines? This comprehensive checklist explores key compliance areas, offering insights to mitigate risks and protect your brand reputation in 2024.

Download Resource

Origami Risk

From Origami Risk

Explore common pitfalls in core insurance transformations and how to avoid them. Discover comprehensive strategies and best practices to successfully plan and execute a cloud implementation in this comprehensive white paper.

Download Resource

gryphon.ai

From gryphon.ai

This guide empowers insurance carriers and risk managers to navigate complex regulations, safeguarding their brands from costly SMS and text messaging penalties.

Download Resource

Origami Risk

From Origami Risk

Navigating the complexities of P&C core insurance digitization is no easy task. Explore the critical decisions between building or buying and how to achieve operational excellence in this white paper.

Download Resource

Melissa

From Melissa

As more customers “unbundle” their insurance products and spread their business among many carriers, agents must look for creative strategies to retain and grow business. Download this white paper to learn top strategies to ensure success in 2024.

Download Resource

gryphon.ai

From gryphon.ai

Empower your organization to excel in marketing outreach without compromising compliance. This guide offers a roadmap to implement a best-in-class contact compliance strategy so that your organization can continue successful marketing campaigns, ethically and legally.

Download Resource

gryphon.ai

From gryphon.ai

Is your organization protected against costly Do Not Call (DNC) and Telephone Consumer Protection Act (TCPA) violations and fines? This comprehensive checklist explores key compliance areas, offering insights to mitigate risks and protect your brand reputation in 2024.

Download ResourcePropertyCasualty360 Daily News

Subscribe Today and Never Miss Another Story.

As part of your digital membership, you can sign up for an unlimited number of a wide range of complimentary newsletters. Visit your My Account page to make your selections. Get the timely legal news and critical analysis you cannot afford to miss. Tailored just for you. In your inbox. Every day.